August 23, 2016 Updated 8/23/2016

Email Print

So far in 2016, North American resin distribution sounds like a tale of two markets.

Sales totals would indicate that third-party sales of polyethylene and polypropylene — the region’s most widely-used commodity resins — are growing only slightly, but executives at some firms are seeing more positive results.

“We just finished 10 months of our fiscal year, and we’ve already sold more than we did in fiscal 2015,” said Ed Holland, president and CEO of M. Holland Co. in Northbrook, Ill. “And that doesn’t even include Latin America and Puerto Rico. Our organic growth has been double-digit and broad-based.

“Some of the moves we’ve made in the last three to five years are paying off,” he added. “We’ve brought in new people and new product lines.”

Similar optimism is in the air at Osterman & Co. in Cheshire, Conn. “2015 was our best year ever, and we’re ahead of that pace by a little more than 10 percent,” said David Dever, distribution sales vice president. “We’re up almost 30 percent in engineering thermoplastics, 5 percent in polyethylene and 7 to 8 percent in polypropylene. We’re selling a lot of polypropylene into consumer products and caps and closures.”

Mike Pignataro is seeing a similar picture at Bamberger Polymers. “We’re really happy to report the 2015 was a record year — our first billion-pound year — and that we’re on track to surpass that this year, with sales up 12 to 15 percent,” he said.

“Our core continues to be polyethylene and polypropylene, and HDPE is showing good growth,” added Pignataro, who is vice president of North American sales at Jericho, N.Y.-based Bamberger. “Consumer and industrial packaging, automotive and medical are still good markets.”

PolyOne Corp. “is seeing an uptick in polyethylene and polypropylene across the board, on average,” according to Mark Crist, vice president of distribution for the Avon Lake, Ohio-based firm. “Contrary to popular belief, we’re seeing a healthy economy and our customers seem to share that vision.

“Certain segments, like oil and gas exploration, are down,” added Crist, whose unit posted first-half financial growth of almost 2 percent, due in part to lower selling prices for many resins. “But overall, we see confidence levels commensurate with GDP growth levels.”

More subdued responses, however, are heard from other distribution execs.

“The market is flat but steady,” said Shawn Williams, senior vice president of plastics at Nexeo Solutions in The Woodlands, Texas. “We’re not seeing significant growth, maybe slightly above GDP overall.”

Comparisons to GDP growth, of course, aren’t that great in a year when that growth rate is just over 1 percent, as it’s been in the U.S. in recent quarters. “Health care and automotive are doing well for us, and Mexico is coming along quite nicely — it’s been a pocket of strength,” Williams added.

“Overall, there’s a higher level of uncertainty now vs. the first quarter,” said Kevin Chase, president of Chase Plastics in Clarkston, Mich. “Maybe that’s because of the election and the economy. Some people are putting dollar bills in their mattresses.

“The market is just OK,” Chase continued. “We’re not getting any tailwind from the macro economy, which is growing at only 1 percent. Some larger market sectors like automotive and consumer and industrial packaging could do better in the second half if we see some progress.

“But we’re also seeing lower business investment. We can sense vibrations in some market segments, but they’re not shaking like they were.”

This disconnect also was noted by John Moisson, president of Jamplast Inc. in Ellisville, Mo. “There continues to be a migration of producer-direct sales to distribution,” he said. “So distribution should be stronger than the market in general, but for us, year-to-date has been flat.

“Part of that is that prices are down for engineering resins and other materials,” he added. “Our unit volume [in pounds] is up single digits, but it’s like a gas station that sells 1,000 gallons per month. Your sales in dollars could be down even with similar numbers.”

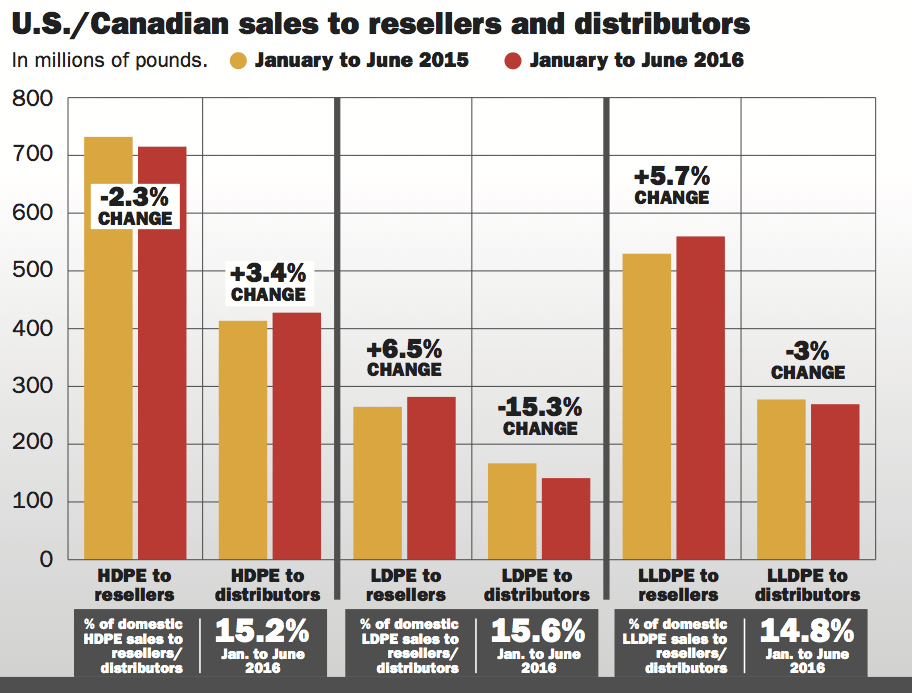

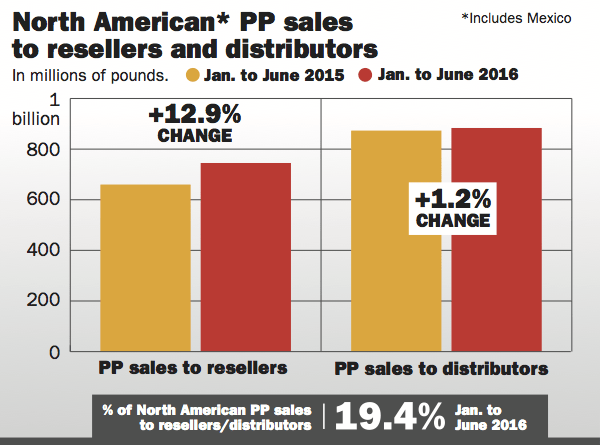

First-half sales totals compiled by the American Chemistry Council showed that U.S./Canadian sales of HDPE to distributors were up more than 3 percent, while sales of PP — including Mexico — were up more than 1 percent. But distributors bought 3 percent less LLDPE and more than 15 percent less LDPE in that six-month period.

First-half sales of those materials to resellers were more positive. Resellers bought more than 5 percent more LLDPE, more than 6 percent more LDPE and almost 13 percent more PP during that period, according to ACC. LDPE — down more than 2 percent — was the only major commodity where sales to resellers declined in the first half.

New facilities, tech

Among other end markets, Chase said that sales into office furniture “are holding steady,” as firms do remodeling work. He added that engineering plastics are being helped by business investments in new applications that are replacing current die-cast metal parts. Much of this type of work is taking place in lightweighting for the auto market.

Chase Plastics has had an incredibly busy 2016. The firm in June opened a $ 6 million warehouse in South Bend, Ind., and a $ 1.3 million customer service center in Clarkston. The warehouse covers 126,000 square feet, while the Clarkston project adds 14,000 square feet, doubling the amount of space the firm previously occupied there.

The center has a computer network that offers up-to-the minute updating of resin pricing and availability, allowing sellers to immediately quote prices to customers. The site also includes video monitors featuring lean ideas that have been generated by employees.

M. Holland also recently upgraded its computer technology with MH2GO, a tablet-based information technology app. The app — which was two years in development — will allow account managers and product managers to have functionality and information when interfacing with customers and suppliers.

M. Holland account managers now can access real-time pricing and inventory information, generate quotes and confirm orders from a customer’s office. For material suppliers, the tool enables product managers to track up-to-the-minute sales activity and report on the status of target projects.

“With one or two buttons, we can now check inventory and get quotes and targets to our product managers, instead of saying ‘We’ll call you back’ and then finding out,” Ed Holland said.

Biopolymers continue to be a good niche business for Jamplast, finding applications in durables, packaging, films and fibers, “In certain situations, biopolymers can do more than a standard plastic can,” Moisson said.

Lower prices, issues with PP and PE

Lower selling prices affected resin distributors in the first half of 2016, as did imports of PP and preparation for billions of pounds of new PE capacity.

“Resin pricing overall has clearly decreased for the first half of 2016 vs. the same period last year,” said Crist at PolyOne. “It’s tracking as usual with a high degree of correlation to oil and natural gas prices.

“However, even in the face of common resin price fluctuations, we’re experiencing growth at industry rates or better and we’re bullish on the future,” he added.

PP imports have driven down prices for that material in recent months. “I’ve never seen the PP market so disconnected as it’s been in the last 12 to18 months,” said Dever at Osterman. “It really started to affect things in January and February. We had to re-set some agreements, even in some cases where customers had specified a certain resin.”

“Polypropylene makers were running full out because of strong demand, and there still wasn’t enough to go around,” Bamberger’s Pignataro said. “Because of that, they were affected by imports.”

But that situation may already be turning. “Imports of PP have slowed down,” said Williams at Nexeo. “They’ve dried up because of lower pricing and softer demand.”

PolyOne’s Crist agreed, saying that his firm “has managed through the influx of [PP] imports, which accelerated thanks to price increases from domestic producers.

“As pricing has come back to earth domestically, this issue seems to have resolved itself,” he said.

Distributors also are looking forward to new PE capacity being added in North America as a result of low-priced shale gas feedstocks. Regional PE capacity could increase by as much as 30 percent between early 2016 and the end of 2017.

“If you look at a domestic PE market of about 40 billion pounds, GDP growth of 2 percent means you’re going to need 800 million more pounds every year,” Ed Holland said.

“We’re geared up for all of the new PE from shale,” said Dever at Osterman. “We’re trying to find prime, branded growth, and we’re bullish on all market sectors.”

“We’re pretty excited about the growth in the [PE] in industry,” added Pignataro at Bamberger. “We’re gearing up our sales force to promote new products in the marketplace.”

But even as new capacity ramps up, Nexeo is keeping an eye on domestic PE demand growth that’s been less than expected. “The domestic [PE] market isn’t in position to support itself, and that has to be a concern overall,” Williams said. “We expected demand to be a lot stronger, but it’s not, and that could put more pressure on exports.”

Help is on the way

New capacity to sell and new markets to conquer have led to help wanted calls from distributors.

Chase plans to add 4 to 5 sales reps in the next year in the U.S. and Mexico. Jamplast already has added two sales reps this year and is looking to hire a sales manager — a position that Moisson had been filling himself.

Osterman has added 10 sellers in the last 3 to 5 years and currently has more than 20 sales trainees, Dever said, as the focus on prime, branded sales has increased its need for personnel.

“We’re optimistic because we’ve hired so many new people,” he added. “We’ve got more people banging on doors.”

Bamberger “continually tries to increase the size of our sales force,” Pignataro said. The firm will hire six new sellers in 2016, increasing the size of its sales staff by 10 percent. Three of those six are already on board, Pignataro added, while the other three will be hired by the end of the year.

The big move

The North American resin distribution field still seems to be coming to grips with last year’s mega-move — the sale of a two-thirds stake in Nexeo to W.L. Ross Holdings for $ 1.7 billion.

“We’re excited about the partnership with W.L. Ross,” Nexeo’s Williams said. “It’s going to position Nexeo for growth organically and in mergers and acquisitions.

“Our goal is market leadership,” he added. “We believe that plastics and chemicals distribution is highly fragmented and is prime for a roll-up strategy. The Ross team has a lot of expertise in complex transactions. That should help us to consolidate and grow faster.”

The Nexeo-Ross deal was the biggest blow to date in a series of moves that have seen other distributors make smaller acquisitions in order to supply growth. Executives interviewed for this story said that trend shows no signs of slowing down for the rest of 2016 and on into 2017.

“Distribution is still fragmented,” said Ed Holland, whose firm has made five acquisitions since 2012. “It wouldn’t be a shock to see the market continue to consolidate. To be a player in plastics, you have to be a supplier of all types.”

Ravago Group also has been active on the acquisition front, earlier this year buying specialty chemicals distributor TH Hilson Co. of Wheaton, Ill., as well as becoming full owner of chemicals distributor Campi y Jove of Barcelona.

Ravago — based in Arendonk, Belgium, with North American headquarters in Orlando, Fla. — also has bought four other European specialty chemical distributors since 2013. The firm’s existing North American resin distribution units include H. Muehlstein & Co. and Amco Polymers.

“We’re going to continue to invest in our distribution business and infrastructure for our customers and supply partners,” Ravago Americas president James Duffy said. “And we’ll make strategic investments where it makes sense.”

Part of this increased activity could be the result of deals boosting low organic growth, as well as of longtime owners or executives looking to exit the market.

“My phone isn’t ringing off the hook, but I can get an offer [for the business] if I want one,” said Moisson at Jamplast. “If you’re not growing organically, you can go buy market share. And borrowing money is cheap today.”

“We’re all going through the same thing,” Kevin Chase said. “If the boss wants you to do 10 percent growth and organic is only getting you 2 percent, you can’t share-shift that much volume. So M&A is going to be hotter than ever.

“We might see some bolt-on acquisitions in the next couple of years,” he added. “Some of these owners aren’t young guys anymore.”

Second half kickoff

Executives interviewed for this story said they expect North American resin distribution to match or exceed its first-half performance in the final six months of the year.

At PolyOne, Crist said that his firm’s strengths — including collaborative engagement with customers, technical support and supply chain management services “have been the winning combo for growth.”

Customer attitudes “can be a mixed bag,” according to Pignataro at Bamberger, but he said he was encouraged by a recent visit with a customer who “was putting in a lot of new equipment and ordering a lot of upgrades.”

“In the second half, we hope to stay on target,” Pignataro added. “We’re doing a much better job of forecasting and projecting more continuity with our customers. That’s good for processors who rely on distribution networks.”