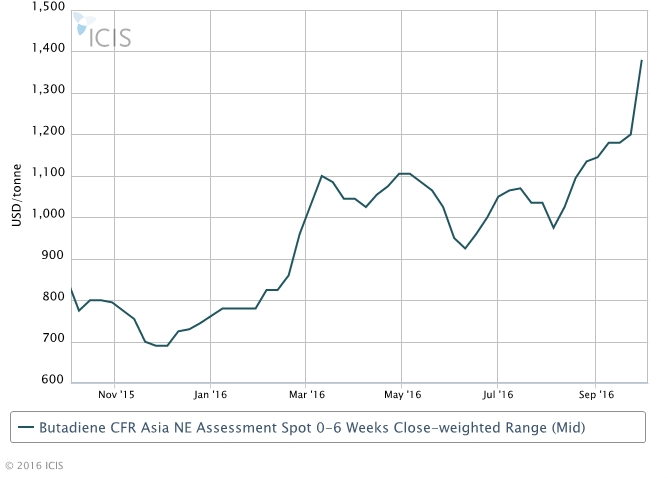

SINGAPORE (ICIS)–Asia’s spot butadiene (BD) prices are having a welcome respite, after surging by more than 42% since early August, amid the week-long holiday in China, market players said on Tuesday.

China, which is a key BD market in Asia, is on holiday from 1-7 October for the celebration of its National Day, while most regional players are also out attending the 50th Annual European Petrochemical Association (EPCA) meeting being held in Budapest, Hungary, on 1-4 October.

But tight BD supply in Asia will continue to exert an upward pressure on prices going forward, market sources said.

No firm offers were heard this week, according to suppliers, but traders were bidding at around $1,450/tonne CFR (cost and freight) northeast (NE) Asia.

On 30 September, BD spot prices were assessed at $1,350-1,410/tonne CFR NE Asia, representing a $405/tonne surge from 5 August, according to ICIS data.

“BD supply is really super tight,” a trader said.

Shell’s declaration of force majeure on base chemicals supply from its petrochemical complex at Pulau Bukom in Singapore on 29 September fuelled the $200/tonne spike in BD prices last week, market sources said. The complex has a BD unit with a 155,000 tonne/year capacity.

Supply in Asia has been tighter-than-expected over the past two months owing to a combination of plant outages, delayed deliveries, scheduled turnarounds and less BD yield from crackers switching to using more liquefied petroleum gas (LPG) as feed. LPG yields less BD compared with naphtha cracking.

A further tightening of supply can be expected next month as Bangkok Synthetics (BST) has decided to bring forward the month-long maintenance at its 140,000 tonne/year BD unit in Thailand to mid-November, market sources said. The turnaround was originally scheduled next year.

In Taiwan, CPC Corp is also expected to shut its 60,000 tonne/year No 4 BD unit in Linyuan this month. The unit, which sustained damage from the typhoon that hit Taiwan in September, will be down for about 10 days of repair works.

On the demand front, some improvement was seen as some downstream synthetic rubber plants have resumed production after turnarounds, while others have raised operating rates due to contractual commitments, market sources said.

BD is a raw material used in the production of synthetic rubbers, which go into tyres for the automotive industry.

Offers were raised for October shipments of downstream styrene butadiene rubber (SBR),polybutadiene rubber (PBR) and acrylonitrile butadiene rubber (NBR), but the pace of the price increase was not comparable to BD’s surge, market sources said.

“We are really worried whether the downstream synthetic rubber market can support this continuous price increase in BD,” an Asian BD supplier said.

A PBR producer revised up its offers to above $1,850/tonne CFR southeast (SE) Asia this week because of BD’s price spike.

“I have just returned from a business trip when SBR 1502 prices were at $1,500/tonne and PBR at around $1,650/tonne CFR SE Asia. Now offers for SBR, PBR and NBR have jumped up by another $100-200/tonne this week,” a rubber distributor said.