Global prices are now higher than in Indian market

Natural rubber (NR) exports from India, which stood at an extremely low level for the past three years, may pick up in the second half of the current financial year, taking advantage of the spurt in international price, according to the Rubber Board.

Owing to the price advantage, the NR exports during this year might touch the 5,000-tonne mark, a Rubber Board press note on Saturday said.

The price of NR in the indigenous market was at a higher level over the international market since December 2013. However, this gap has come down in the third quarter of 2016 with global prices picking up from the second half of November.

International prices now hover at a higher level than the Indian market prices. A combination of reasons could be attributed to the present spurt in global NR prices, which include increased demand from China, upward trend in crude prices, appreciation of the US dollar, and the speculative trend marked by the surge in the Tokyo Commodity Exchange and Shanghai Commodity Exchange.

Sensitive to speculation

The NR prices are highly sensitive to speculative news in most of the rubber-producing countries. But in India, a major consuming nation, the response to speculative price movements owing to reasons not specific to domestic market would be relatively less, the press note said.

However, the Indian rubber prices generally track international prices and the market adjusts to global prices forthwith, often with a time lag. The Rubber Board wanted to capitalise on the price advantage by promoting export and raise the NR prices in the indigenous market to world market levels.

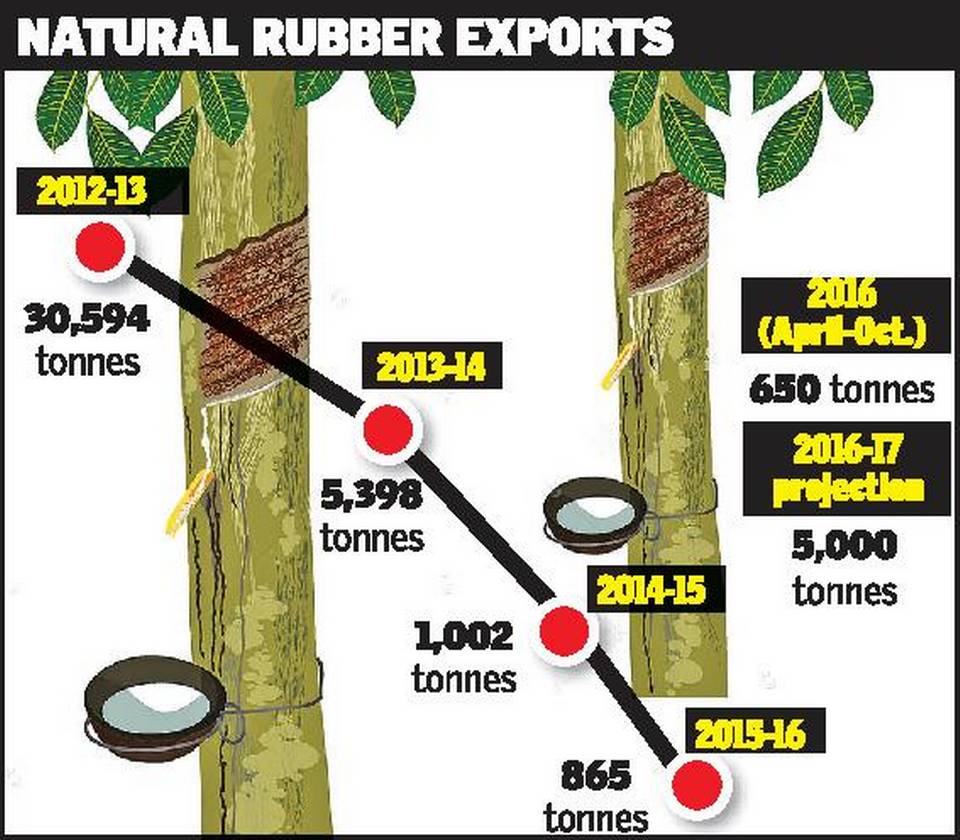

The NR export trends during the April-October 2016 period followed the pattern for the past three years and stood at hardly 650 mt. However, the Rubber Board hoped the relative price advantage would result in an export spurt and help it to touch the 5,000-tonnne mark by the end of this fiscal.

NR exports, which stood at 30,594 tonnes in 2012-13, had registered a sharp plunge taking it to 5,398 tonnes in 2013-14 and to 1,002 tonnes during 2014-15. However, the worst scenario was during 2015-16 when Indian exported just 865 tonnes.