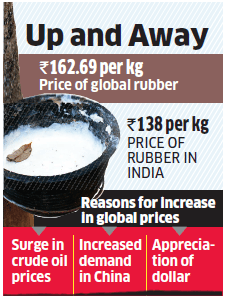

KOCHI: Natural rubber prices in India may touch Rs 150 per kg in a few weeks, traders said, as the commodity continues to gain momentum in a rally that started last month. They said prices are moving in tandem with the international prices, which spurted toRs 162.69 per kg, thanks to a surge in crude oil prices, increased demand in China and appreciation of the dollar. In India, the commodity was trading at Rs 138 per kg at the end of last week.

“The indication is that Indian prices will rise to Rs 150 per kg or more, narrowing the gap with the international price,” said CP Krishnan, whole-time director at Geofin Comtrade. “International prices are unlikely to crash in the short term as Chinese demand looks robust and crude oil prices are likely to remain at the current level.”

According to a senior executive at the Rubber Board, Indian rubber prices generally track international prices and the market invariably adjusts to international prices often with a time lag.

Prices in India had been ruling above the international prices since December 2013. But the situation changed in the middle of last month. Though it is the peak harvest season, tapping has been partially affected by demonetisation and insufficient northeast monsoon.

“Those who installed rainguard and began tapping earlier are getting lesser yield than those who have begun later,” said George Valy, president at Indian Rubber Dealers Federation. “The peak season is likely to come to an end by mid January because of the dry weather.”

Valy said more rubber would have flowed to the market had there been no restriction on cash withdrawals from banks in the wake of demonetisation.

Higher international prices have made imports costly. “Consumers have no choice but to buy from the Indian market. Import contracts for the next three months could fall considerably,” Valy said.

But purchases by the rubber industry, especially tyre makers, may not show a significant increase, given downswing in sales.

To add to their woes, a rise in crude oil prices has also resulted in an increase in the price of synthetic rubber, an important raw material derived from petrochemicals.