MUMBAI: The rally in tyre stocks is unlikely to continue, as the price of the sector’s most important raw material is heading north, analysts said.

Rubber prices, which have been range bound for the past several months, are expected to increase on the back of a fall in production in the key rubber producing countries as well as the increasing crude oil prices.

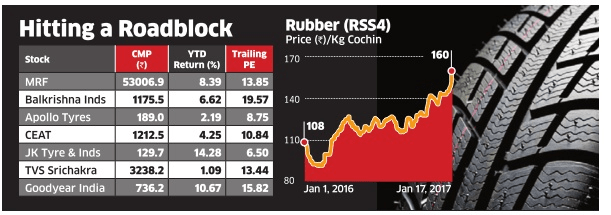

Shares of market leader MRF have rallied nearly 8% and those of JK Tyre & Industries by 15% since January 1. Among others, Goodyear India rose 11%, Balkrishna Industries nearly 7% and Apollo Tyres, about 3%. Last week, MRF hit a record high, crossing the Rs 55,000mark on the BSE in intra-day trade.

“With rubber prices likely to head north and rubber accounting for 5560% of the raw material cost for tyre manufactures, we believe gross margins would be under pressure,“ said IIFL analyst Prayesh Jain. “Stiff competition in most tyre segments will restrict ability of companies to pass on the higher cost to customer.“

The domestic price of the RSS-4 variety of natural rubber surged about 76% from last year’s low of Rs 91 to Rs 160 as of Wednesday.

Rubber prices are likely to rise as key producers Thailand, Malaysia and Indonesia reported a fall in production on the back of extreme cli mate and regulatory clamp down.Also, natural rubber prices have a strong correlation with those of synthetic rubber, which is made from crude oil.

Demonetisation is making an impact on the tyre industry also as automakers are reporting pressure on sales.

“Volume growth in the auto sector has taken a back seat since demonetisation whereas inputs cost for tyre companies have gone up drastically , hence the near-term outlook for tyre stocks looks bleak,“ said G Chokkalingam, CEO of Equinomics Research & Advisory .

Both domestic and foreign institutions have reduced their holding in Balkrishna in the December quarter.