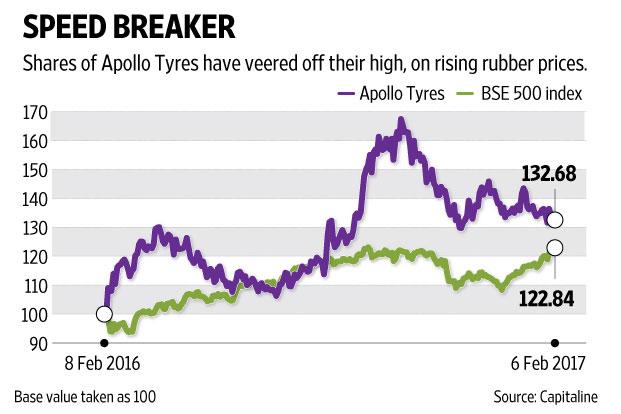

For Apollo Tyres, rising raw material prices tempered the company’s profitability and the bigger concern is there is no sign of them cooling off

At Apollo Tyres, strong domestic sales were a positive surprise amid challenges. Photo: Reuters

No doubt, Apollo Tyres Ltd’s December quarter performance raced past Street expectations on all fronts. But rising raw material prices tempered the company’s profitability and the bigger concern is there is no sign of them cooling off.

In fact, Apollo Tyres’ management in the analysts’ call cautioned investors that there could be a 10% increase in overall raw material costs in the March quarter too. This is not surprising given that RSS Grade-4 rubber prices (used in tyre manufacture) alone surged by about 40% over the last 12 months. Other commodity prices like synthetic rubber, whose price is linked to crude oil, are up too.

No wonder then that the December quarter’s operating margin fell by about 270 basis points year-on-year to 14.4%, although higher than Bloomberg’s forecast. A basis point is one hundredth of a percentage point.

What came to Apollo Tyres’ rescue was its robust sales, which grew by 17.3% to Rs3,457 crore at the consolidated level.

Demonetization, which was a roadblock for auto sales to some extent, helped the company. As cash transactions fell, demand for Chinese/Korean tyres dropped too, especially in the truck and bus segment.

Strong domestic sales were a positive surprise amid challenges. But the 54% jump in European revenue was a bonanza. Demand for winter tyres in Europe was better than what the analysts had penciled in. Meanwhile, the acquisition of German tyre distributor Reifencom GmbH added to international revenue too, which on the whole surged by about 54%.

That said, higher costs also took a toll on operating profit, which dropped by 1% from a year ago.

Unfortunately, Apollo Tyres’ borrowings too have risen at a time when overall raw material costs are on a roll. Net consolidated debt at the end of six months ended September 2016 had more than doubled to Rs1,612 crore from the year-ago period. Therefore, December quarter’s interest cost was up by 46% from a year earlier.

In spite of this, the company’s consolidated profit of Rs295.8 crore was a huge beat on Street expectation. That said, it was only 6% higher than the year-ago period.

The point is that rising costs will continue to contain profit growth. To some extent, high revenue growth can provide an operating leverage. Meanwhile, in January, the company along with most other tyre makers hiked prices in the replacement market, as cost pressures are unlikely to ebb soon. Some dealers say that further price hikes cannot be ruled out.

Meanwhile, Apollo Tyres’ stock has been running downhill since October when investors sensed that rising raw material and interest costs may keep net profit expansion subdued. From this level, revenue growth is certain quarter after quarter, but it may not translate into a commensurate growth in profits.