Rubber manufacturing companies have called for a review of the government’s existing policy for the sector by giving thrust on indigenous production.

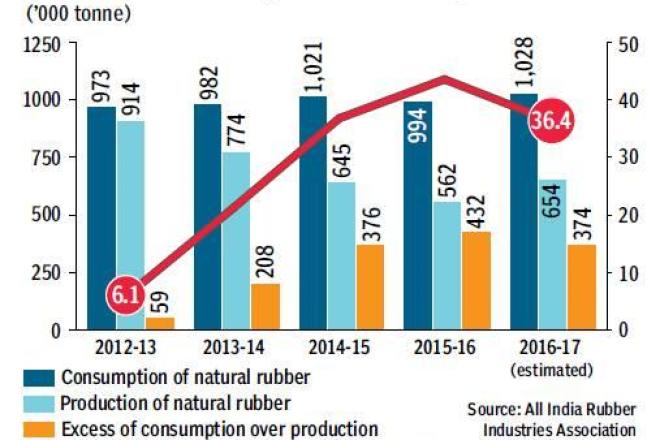

The industry body also suggested that the Rubber Board data for the period April-June FY17 showed the broadening of demand-supply gap — equivalent to nearly half of the domestic demand.

Rubber manufacturing companies have called for a review of the government’s existing policy for the sector by giving thrust on indigenous production. These companies say they are faced with a double whammy — continued shortage of domestic availability of natural rubber, and inverted import duty structure — wherein duty rates of raw material imports are much higher rate than that on finished rubber goods.

The inverted duty structure is putting pressure on our cost competitiveness, thereby discouraging indigenous production of rubber goods, said Sashank Kulkarni, secretary general, All India Rubber Manufacturing Industries (AIRIE). With a major part of the rubber production being in the informal sector, comprehensive data is not available, compounding the worries of the industry and the policymakers.

AIRIE has already submitted a representation to the ministry of micro, small and medium enterprises to develop a comprehensive database for the rubber industry, Kulkarni said.Domestic availability of natural rubber (NR) would fall short of total consumption in the country during the current fiscal, despite a turnaround in production. AIRIE estimated the shortfall to be 5 lakh tonne, which is around 36.4% of total raw rubber consumption in the country.

The industry body also suggested that the Rubber Board data for the period April-June FY17 showed the broadening of demand-supply gap — equivalent to nearly half of the domestic demand. Ensuring sustained availability of NR in open market is a major challenge as shortages create uncertainty among domestic consumers.

Continued shortfall in domestic rubber supplies resulted in steady increase in imports during the period FY13 to FY16. This must have already affected employment levels and SME units in the rubber industry. Kulkarni noted that a lot of smaller rubber items such as cello tapes, earlier produced in India, has now been replaced by imports.

Rubber manufacturing companies highlighted the current inverted duty structure for a range of products recently in their pre-Budget (FY18) memorandum to the central government and urged for immediate correction but without success.

Finished products made from NR are imported at 0% duty from countries like China, Sri Lanka whereas these are imported into India at “25% or R30/kg whichever is lower”. All rubber manufactured products made of synthetic rubber (SR) such as conveyer belts, V-belts, 0-Rings, among others, are imported at 0-5% duty under India’s FTA with Asian countries whereas SR is imported into India currently at 10%.

NR is kept under the negative list across most FTA except for Asia Pacific Trade Agreement (APTA) implying no concessions is granted on import duty rates.

However, in both APTA and SAFTA (South Asian Free Trade Agreement) the concessional duties apply mainly for NR imports from Sri Lanka which are anyway insignificant and hence of no practical significance to India.

In addition to this, import duty on raw materials is highest in India when compared to neighbouring rubber manufacturing countries. Import duty on NR in China is 10% as against 25% or R30 per kg in India. On natural rubber latex the import duty is 70% in India while it is just 10% in China.

On the other hand, import duty on finished rubber goods is lowest in India when compared to other rubber consuming countries facilitating rubber imports into India.