Highlight

-

Thai rubber manufacturer are marching into 2017 along with three major developments : 1) rubber prices bottomed out last year, with the price of Ribbed Smoked Rubber Sheets (RSS3) rising along with crude oil prices 2) rubber suppliers in the CLMV countries have stepped up their roles in diminishing Thai suppliers’ dominance 3) increased bargaining power against tire companies after Sinochem’s acquisition of several rubber companies which concentrated the market into the hands of a few large players.

-

EIC sees an opportunity for the Thai rubber industry to refocus towards value-added rubber products such as rubber gloves. Both the private and public sectors should collaborate on R&D for new products. There are also opportunities to partner with Malaysian companies interested in investing in the rubber glove industry.

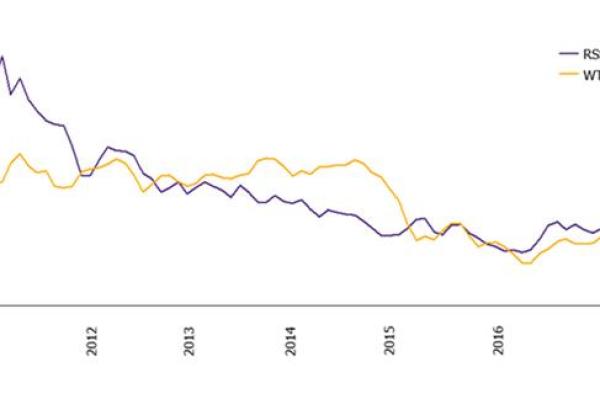

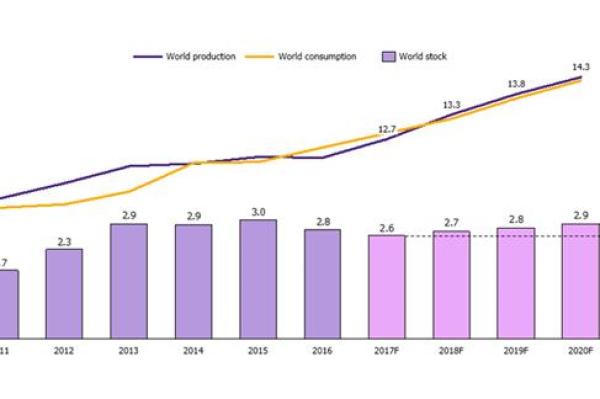

The rubber industry struggled with falling rubber prices during 2014 – 2016. This year, the industry took a positive turn along with 3 significant developments. First, rubber prices are projected to rise in 2017 along with the recovery of crude oil prices and reduced supply from floods in the Southern provinces, putting an end to the downward trend in rubber prices. The price of RSS3 remained low during 2014 – 2016, with an average price of 55-57 THB/kg. In 2017, the average price regained its upward trend to move above 60 THB/kg. The main contributing factor is a rebound in global crude oil prices, which recovered to a level of 50-55 USD/barrel from as low as 37 USD/barrel in early 2016 (Figure 1). The rise in crude oil prices has been driven by an OPEC production cut and the recovery of the global economy, especially the U.S. Additionally, floods in the Southern provinces of Thailand in late December 2016 to January 2017 restrained rubber supplies. EIC sees the Thai rubber output in 2017 reaching 4.3 million tons, a 3% drop from the previous year. Lower Thai output, combined with a decline in global rubber production over the past two years due to unsuitable climate conditions, translates to a 7.1% drop in global rubber stocks this year at 2.6 million tons (Figure 2). These two factors contribute to higher prices, signaling an end to the downward trend. EIC projects an average rubber price for 2017 of 72.5-77.5 THB/kg, with the price gradually declining in the second half of the year after rubber trees have shed leaves and Thai rubber production returns to normal.

Nonetheless, rubber prices will not rise significantly in the medium term given the projection of a small increase in crude oil prices. An increasing rubber supply will also put pressure on prices in the medium term. Even though the recent recovery in oil prices has contributed to the rise of rubber prices this year, the price of oil is capped by the potential supply from shale oil producers in the U.S. EIC expects oil prices to move within a range of 60-70 USD/barrel in the medium term, restraining future rubber prices. Furthermore, the rubber supply is projected to increase with a global rubber stock that will begin accumulating in 2018 (Figure 2).

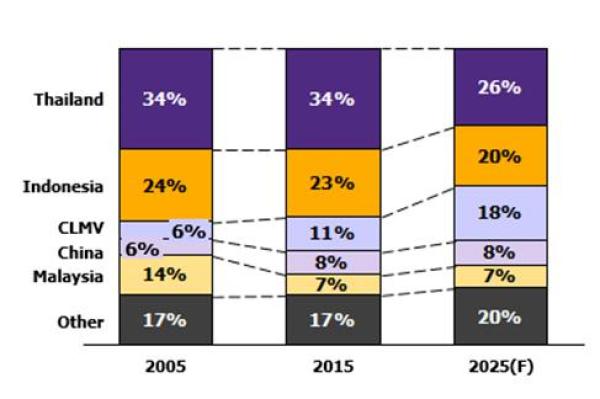

The second development is the reduced role of Thai rubber suppliers in the global market, while suppliers in the CLMV countries step up their production. Accelerated expansion of rubber planting areas in the CLMV countries in 2006-2018 will greatly increase production levels in these respective countries in 2013-2025. The IRSG (International Rubber Study Group) expects CLMV’s rubber production to increase from 1.4 million tons in 2015 to 3.2 million tons in 2025. The increase will make the CLMV’s share of global rubber production jump from 11% in 2015 to 18% in 2025. At the same time, the share of Thailand’s production will decline from 34% of total global production to 25% in 2025 (Figure 3). The change is due to a shift to other crops by Thai farmers such as palm oil, which provides higher returns. Moreover, the Thai rubber industry is also losing competitiveness to those in the CLMV due to their cheaper labor costs.

Last but not least, recent mergers and acquisitions (M&A) have increased the concentration of firms in the rubber industry. This will enhance the bargaining power of rubber manufacturers against tire company. Sinochem, a large Chinese rubber manufacturer, has recently merged and acquired several other players in the same industry. The company now has a very high level of production capacity and total sales. Its bargaining power against tire companies improved significantly given its ability to control a longer supply chain from downstream to upstream processes. Moreover, the company maintains large sales and transportation networks covering ASEAN, China, South Africa, the U.S., and Europe. In addition, Sinochem’s M&As substantially changed the industry landscape from an industry with many small players to a few large one. The smaller number of manufacturers mean higher bargaining power. To put things into perspective, the six largest rubber manufacturers have combined sales of 5.94 million tons, while the six largest tire companies needs as much as 3.95 million tons of rubber. The change in the industry landscape therefore will give rubber manufacturer a better bargaining position.

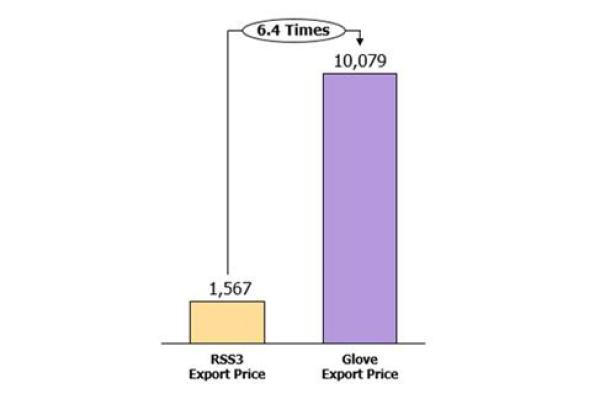

Thailand has an opportunity to raise the level of value-added rubber industry products through the development of rubber gloves and other rubber products, doing so will also improve the country’s export competitiveness. In the past, Thailand has exported a large volume of raw rubber, while exports of value-added products such as rubber gloves comprised only a small portion of exports. The contrast is particularly stark when compared to Malaysia, which has continuously developed a fully integrated production chain for rubber gloves, an industry that continues to thrive. Based on data from the Malaysian Rubber Board, Malaysia’s exports of rubber gloves surged from 12 billion pairs in 2000 to 34 billion pairs in 2015. This averages to an annual growth of 7.5% for 15 years. The rubber glove industry also has strong prospects boosted by growth in the healthcare industry, the rising share of the aged population, and efforts to raise public health standards in developing countries. Indeed, rubber glove exports brought in much as 2.9 USD billion to Malaysia in 2015. The unit price of rubber gloves is 6.4 times higher than that of RSS3 (Figure 4). Another advantage of exporting rubber gloves is the stability in prices relative to prices of RSS3.

-

EIC recommends investing in rubber glove production. The industry has strong growth potential, with Thailand having an upper hand in abundant raw materials. The industry also provides high returns. One of the industry leaders has a 5-year average return on assets (ROA) as high as 17.5%. Large factories are required to create economies of scale. This will also pay off the initial fixed costs of the required technology. Partnering with Malaysian firms that are interested to invest in Thailand is also a viable option to reduce risks as they can bring in a deeper understanding of the business, market demand, and long-time experience.

-

The government should also systematically support the rubber glove industry. Support should cover many areas, ranging from R&D to improved product quality such as hypoallergenic gloves, product design and brand marketing plans, and tax deductions for R&D expenses.

Figure 1: Rubber prices rise in 2017 along with recovering crude oil prices.

Unit: THB/kg, USD/barrel

Source: EIC analysis based on data from Bloomberg

Figure 2: The global rubber supply is projected to rise, putting pressure on future rubber prices in medium term.

Unit: Million tons

Source: EIC analysis based on data from the International Rubber Study Group

Figure 3: In the future, the role of Thailand as the major rubber supplier will be diminished by CLMV countries.

Unit: Percent

Source: EIC analysis based on data from the International Rubber Study Group

Figure 4: Exports of rubber gloves generate value-added of 6.4 times higher than exports of RSS3.

Unit: USD/ton

Source: EIC analysis based on data from the Ministry of Commerce

DOWNLOAD FILE