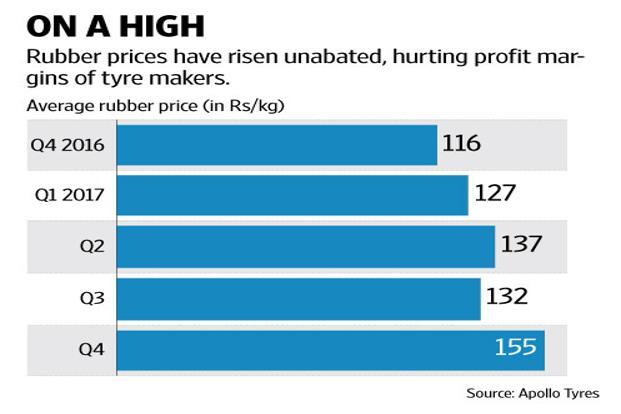

Apollo Tyres’ consolidated revenue growth of 10% was hardly enough to cover the 33% run-up in rubber price (average for the quarter) from a year back

The March-quarter performance of Apollo Tyres Ltd reflects the damage done by galloping rubber prices to its profits. Consolidated revenue growth of 10% was hardly enough to cover the 33% run-up in rubber price (average for the quarter) from a year back. Worse, it shot up by 17% in just the three months of the quarter, taking tyre makers by surprise.

Apollo Tyres stock has been in reverse gear since the results were declared and trades at a reasonable eight-nine times one-year forward estimated earnings. Photo: Ajay Negi/Mint

As a result, raw material cost as a percentage of sales vaulted by 710 basis points year-on-year and about 380 basis points from the immediately preceding quarter. A basis point is one-hundredth of a percentage point.

In fact, Apollo Tyres marked up prices by around 5-6% in-line with others in the pack, but it was insufficient to cover cost increases. So, the consolidated operating margin contracted by 534 basis points year-on-year to 11%, which was also way off the milestone of 13.4% set by the Street.

Operating profit too plunged by 25%. It would have been less severe if sales were better. But then, with nearly 70% of the company’s sales catering to the replacement market, the lingering effect of demonetization and tepid demand in the truck segment during the quarter weighed on domestic sales.

Consolidated net profit dropped by 17% to Rs228 crore, again below what the Street had penciled in. No wonder, the Apollo Tyres stock has been in reverse gear since the results were declared and trades at a reasonable eight-nine times one-year forward estimated earnings.

Fortunately, European and American sales expanded by 15% when compared to a year back although they were weaker than the December quarter, which is seasonally a better one, when special winter tyres are in demand.

Nonetheless, Apollo Tyres’ capacity addition in both domestic and European operations mirrors optimism on demand growth. Brokerage firms’ reports echo the sentiment given that the auto segment is likely to post higher growth rates than in the last couple of years. Importantly, Chinese and Korean tyre imports that undercut domestic prices are now much lower than a year back, perhaps due to demonetization.

In the final analysis, however, one cannot undermine the impact of rubber price on tyre firms’ profits. An Emkay Global Financial Services Ltd report says that for Apollo Tyres, fiscal year 2019 is likely to bring in better margins due to better performance in Europe and a correction in raw material prices. In fact, the stock has rallied since April, when rubber prices started ebbing.