US500

+1.45%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CVX

+2.69%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CSCO

+0.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

JNPR

+1.37%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IBM

+2.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+1.07%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

FTNT

-0.74%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ANET

-2.51%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Fed policy uncertainty, worries over a looming recession, and stubborn inflation will continue to dictate investor sentiment in 2023.

I used InvestingPro’s stock screener to find undervalued, high-quality stocks with a potential of at least 15%.

InvestingPro predicts high returns for these stocks in the coming months.

Looking for a helping hand in the market? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

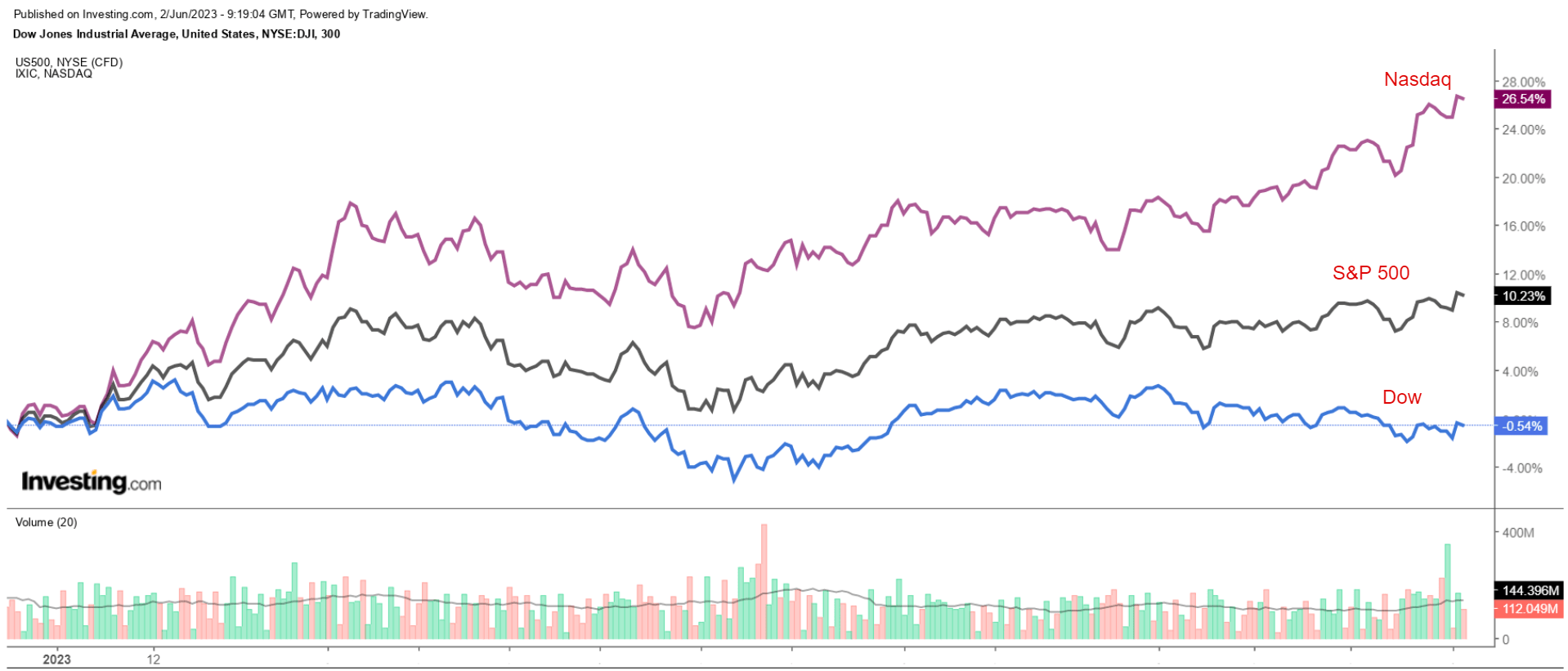

U.S. stocks have rallied this week, with the S&P 500 and the Nasdaq rising to fresh 2023 highs as investors cheered an agreement to raise the U.S. debt ceiling in time to avert what would have been a first-ever default.

Nasdaq Vs. S&P 500 Vs. Dow Jones

Nasdaq Vs. S&P 500 Vs. Dow Jones

Source: InvestingPro

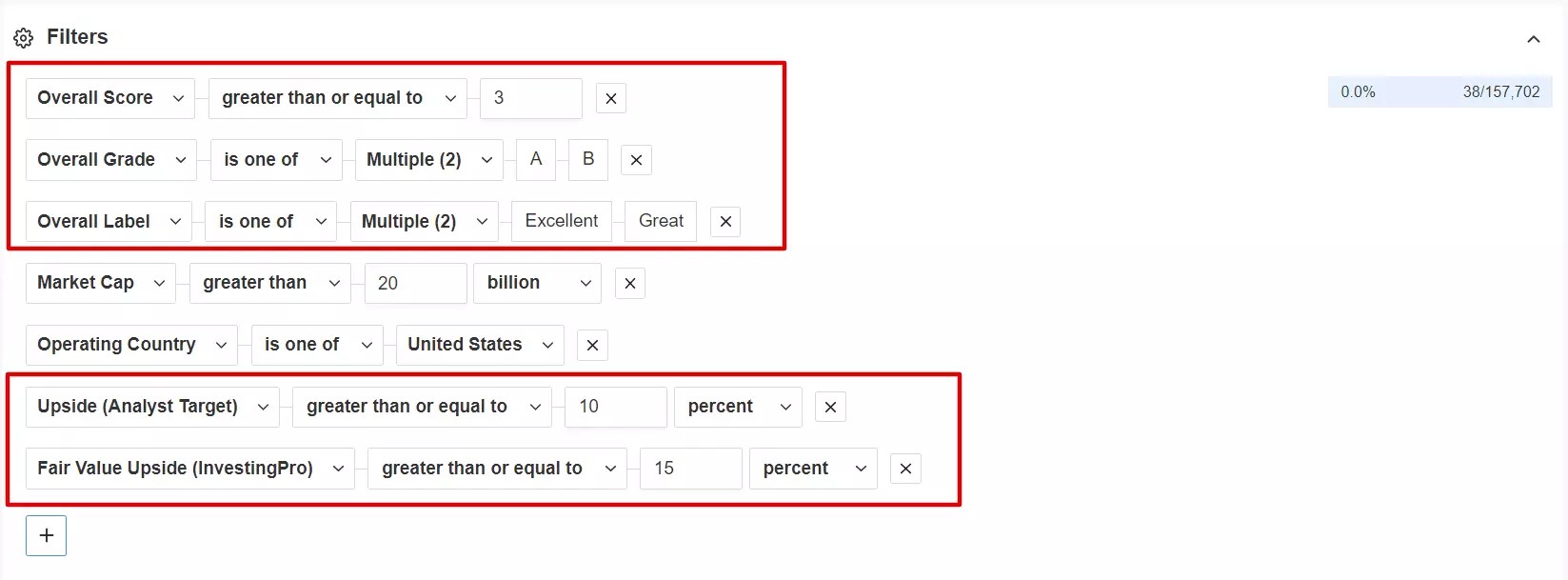

Amid the current backdrop, I used the InvestingPro stock screener to identify undervalued stocks with solid profitability, healthy cash flows, and robust earnings prospects that Wall Street analysts are still bullish on and have a potential ‘Fair Value’ upside of at least 15%.

InvestingPro Stock Screener

InvestingPro Stock Screener

Source: InvestingPro

I first scanned for companies whose InvestingPro ‘Financial Health’ grade was either ‘A’ or ‘B.’ The InvestingPro grade benchmarks are an advanced stock ranking system that considers over 100 metrics pertaining to the company’s growth, profitability, cash flow, and valuation and then compares companies against each other. The best-performing companies on these metrics are the healthiest.

I then filtered for names with an InvestingPro ‘Fair Value’ upside greater than or equal to 15%. The Fair Value estimate is determined according to several valuation models, including price-to-earnings ratios, price-to-sales ratios, and price-to-book multiples.

And those companies with a market cap of $20 billion and above made my watchlist.

Once the criteria were applied, I was left with 38 companies. Each name boasts a ‘Strong Buy’ rating recommendation and offers significant upside potential based on analysts’ price targets. Of those, Chevron (NYSE:CVX) and Cisco Systems (NASDAQ:CSCO) were the two that stood out the most to me.

InvestingPro Watchlist

InvestingPro Watchlist

Source: InvestingPro

For the full list of the stocks that meet my criteria, start your free 7-day trial with InvestingPro today!

If you’re already an InvestingPro subscriber, you can view my selections here.

1. Chevron

*Year-To-Date Performance: -15.2%

*Market Cap: $288.4 Billion

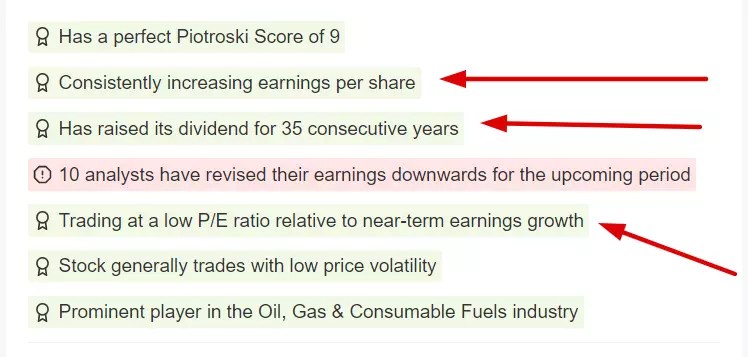

Despite the recent downtrend in its stock, InvestingPro has flagged Chevron – which is one of the world’s leading integrated energy companies – to provide significant long-term value for shareholders in the months ahead.

Demonstrating the strength and resilience of its business, the San Ramon, California-based energy giant sports a near-perfect InvestingPro Financial Health score of 4/5. The Pro Health score is determined by ranking the company on over 100 factors against other companies in the Energy sector.

src=

src=

Source: InvestingPro

InvestingPro also highlights several additional tailwinds Chevron has going for it, including healthy profitability, strong earnings, and solid cash flow growth.

InvestingPro Tool

InvestingPro Tool

Source: InvestingPro

In addition, Pro points out that Chevron currently trades at a low P/E ratio relative to near-term earnings growth – a metric known as the PEG ratio – of 0.11.

The lower the PEG ratio, the more the stock may be undervalued, given its future earnings expectations. In theory, PEG ratios lower than 1.0 suggest a stock is undervalued, while a PEG ratio of 1.0 or above indicates a stock is overvalued.

Beyond its strong fundamentals, the oil and gas behemoth has raised its annual dividend for 35 consecutive years, highlighting its exceptional track record when it comes to returning excess cash to stockholders.

Chevron Dividend Data

Chevron Dividend Data

Source: InvestingPro

Shares currently yield 4.01%, which is soundly above the 1.55% implied yield for the S&P 500 index.

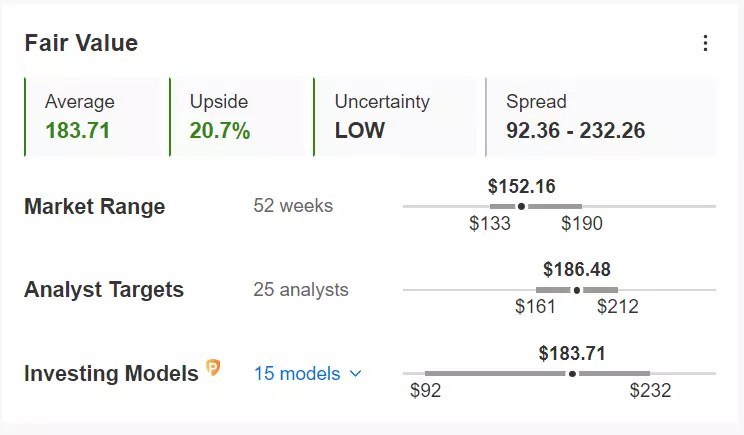

Not surprisingly, CVX stock is substantially undervalued at the moment according to the quantitative models in InvestingPro: with a Fair Value price target of $183.71, Chevron shares could see an upside of roughly 21% from Thursday’s closing price.

Chevron Fair Value

Chevron Fair Value

Source: InvestingPro

Wall Street also remains optimistic about the ‘Big Oil’ firm, with all 26 analysts surveyed by Investing.com rating CVX stock as either ‘buy’ or ‘hold.’ With an average price target of around $186, analysts see an upside of 22.5% from current levels.

2. Cisco Systems

*Year-To-Date Performance: +4.4%

*Market Cap: $202.7 Billion

Cisco Systems stock is up 4.4% this year. According to the InvestingPro models, it should continue appreciating as the networking-infrastructure company grows sales and earnings amid the current AI boom, making CSCO a buy for the near term.

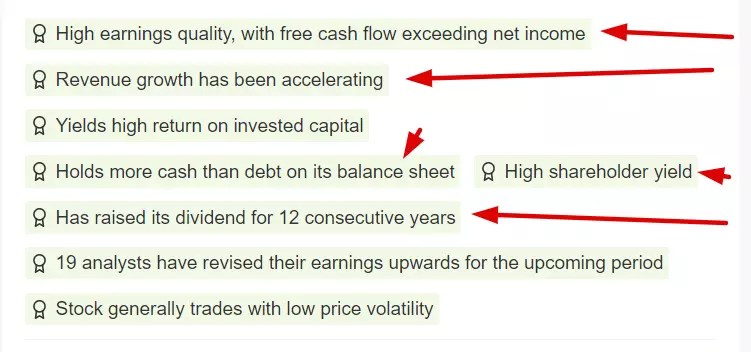

Based on InvestingPro data, Cisco has several tailwinds that are expected to fuel further gains in its stock in the months ahead, with highlights including high earnings quality, strong revenue growth, a pristine balance sheet, and robust growth in free cash flow yields, which should allow it to increase dividend payments.

InvestingPro Tool

InvestingPro Tool

Source: InvestingPro

The San Jose, California-based digital communications technology conglomerate, which designs, produces, and sells networking equipment, has increased its annual dividend payout for 12 years in a row.

At Thursday’s closing price, shares currently yield a market-beating 3.14%.

Cisco Dividend Data

Cisco Dividend Data

Source: InvestingPro

As InvestingPro points out, Cisco is in great financial health condition, thanks to strong profit and growth prospects, combined with its reasonable valuation.

src=

src=

Source: InvestingPro

Cisco’s stock trades at a price-to-earnings (P/E) ratio of under 18, which makes it an absolute bargain compared to its major competitors, such as IBM (NYSE:IBM) (62.5 P/E ratio), Fortinet (NASDAQ:FTNT) (56.3 P/E ratio), Arista Networks (NYSE:ANET) (34.6 P/E ratio), and Juniper Networks (NYSE:JNPR) (20.0 P/E ratio).

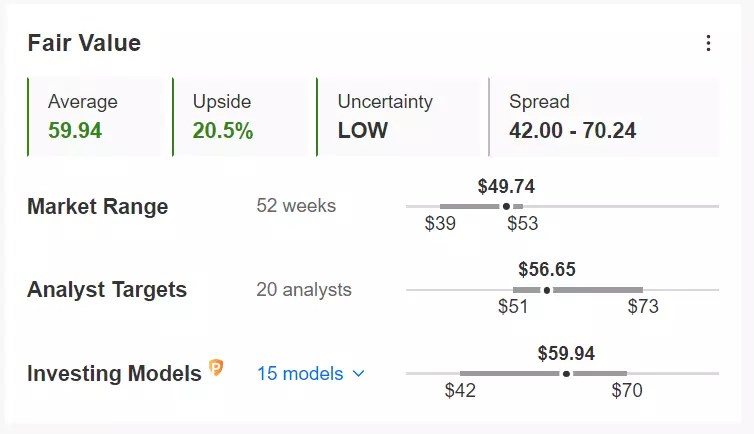

At a current price point under $50, CSCO comes at a substantial discount according to the quantitative models in InvestingPro, which point to an upside of 20.5% in Cisco’s stock from current levels over the next 12 months.

Cisco Fair Value

Cisco Fair Value

Source: InvestingPro

Not surprisingly, Wall Street has a long-term bullish view on Cisco, as an Investing.com survey revealed that 26 out of 27 analysts covering the stock rated it as either a ‘buy’ or ‘hold.’

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, saving you time and effort.

Here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com

![[Geojit Comtrade] Daily report on Natural Rubber: December 4, 2012](https://img.globalrubbermarkets.com/2024/08/geojit-comtrade-daily-report-on-natural-rubber-december-4-2012.jpg?resize=120%2C86&ssl=1)