Global demand for natural rubber (NR) is expected to outstrip supply this year, however the body representing 11 key producing countries cautions that strong demand doesn’t guarantee that the prices seen of late will be maintained.

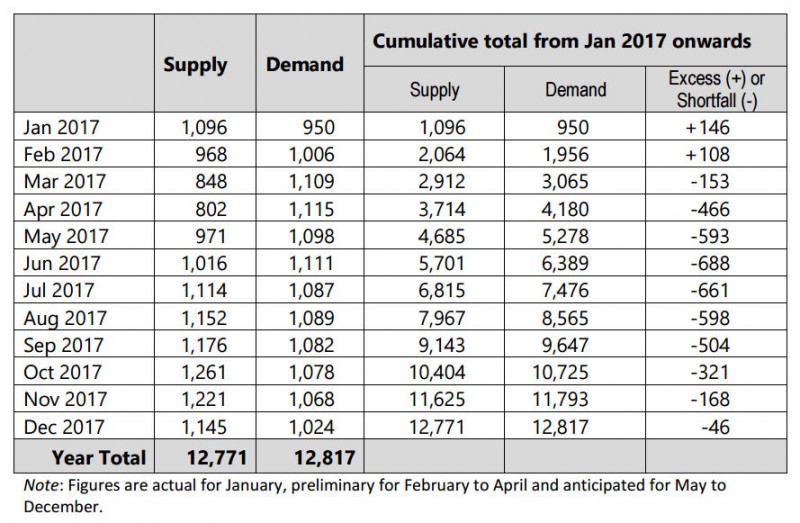

Global supply & demand – January to December 2017 (‘000 tonnes) Source: ANRPC

Projections from the Association of Natural Rubber Producing Countries (ANRPC) suggest that worldwide demand for NR for the entire year will reach 12.817 million tonnes, up 1.8 per cent from 2016, while global supply from both ANRPC member countries and non-member countries will rise 5.7 per cent year-on-year to 12.771 million tonnes.

Supply of NR is estimated to have increased by 5.1 per cent year-on-year, during the first four months of 2017. Thailand and Indonesia account for more than 60 per cent of global NR supply, and while production increased 6.7 per cent in Indonesia, it decreased 7.1 per cent on an annualised basis in Thailand between January and April 2017.

During the first four months of the year, global demand for NR is estimated to have increased by 1.3 per cent year-on-year. While demand grew during the first four months at an annualised rate of 0.3 per cent in China, in India it posted 3.0 per cent growth.

Based upon actual figures of supply and demand during January 2017 and preliminary estimates for February to April 2017, as well as anticipated figures for the remaining months of the year, global supply of NR is likely to remain short of demand during all months to December 2017. The shortfall is expected to progressively widen to reach 688,000 tonnes in June before narrowing down in subsequent months to reach 46,000 tonnes by December.

Looking ahead, the ANRPC expects the natural rubber market to be influenced by several factors in the short-term. Reports of future oversupply arising from the large-scale planting programmes undertaken seven years ago have affected sentiment in the NR market, while on the other hand the anticipated extension of crude oil production curtailment agreements may favour NR prices. A third factor affecting the market is the phenomenon that sees natural rubber prices often tracking directional trends in the wider commodities market regardless of its demand/supply fundamental; in late February, the International Monetary Fund announced its expectation that the price index for “all commodities” would increase 18 per cent year-on-year in 2017. Last but not least, a strong US dollar is viewed as an impediment to a marked recovery in natural rubber market.

“To conclude, natural rubber prices in the next three months will be largely determined by the trends in commodities in general and crude oil in particular,” reports the ANRPC in its latest update on the natural rubber market. The association is confident that the supply and demand dynamic will continue to favour NR producers throughout 2017, particularly in the first half of the year. However, it cautions that the increasing influence of factors aside from supply and demand means that “prices need not reflect the favourable supply-demand condition anticipated in 2017.”