China’s overall 2017 polypropylene demand is about 23.7 million, up a healthy 1.2 million from last year, according to S&P Global Platts Analytics, while the rate of Chinese plant startups have slowed more than expected, with many startups delayed to 2018.

About 1.2 million mt/year of PP capacity is expected to come on-stream in the second half of this year, down from earlier estimates of about 1.9 million mt, so startup capacities and demand are expected to be largely in line with each other this year, according to sources.

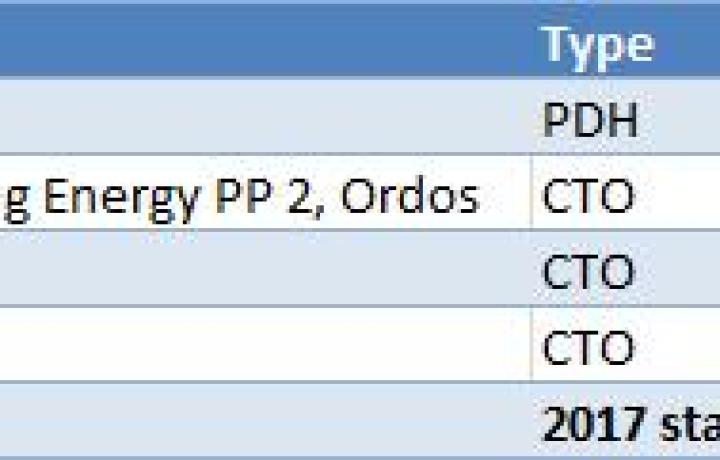

Sinopec Zhong Tian He Chuang Energy will be starting its CTO and associated downstream units in early-July, a company source said.

The CTO has a nameplate capacity of 1.8 million mt/year for olefins, and will feed a 350,000 mt/year PP unit constructed last year along with downstream polyethylene plants.

Shenhua Ningmei is expected to complete the expansion of its No. 3 PP plant, with a nameplate capacity of 600,000 mt/year, in September.

Shanxi Coking Company’s 250,000 mt/year PP plant is slated for startup in Q4 2017, but could get delayed, industry sources said.

Jiutai Energy’s 300,000 mt/year PP plant in Ordos and CNOOC Shell Petrochemical’s 400,000 mt/year PP plant in Huizhou were slated for startup in Q4 this year but has been pushed to 2018, the sources said.

CHINA PP IMPORTS TO SLOW IN H2 AS FUTURES DEFLATE

A surge in China’s PP futures prices in February led to an explosion of imports in Q1, but imports are likely to slow down in the medium term as the market digests the excess supply, industry sources said.

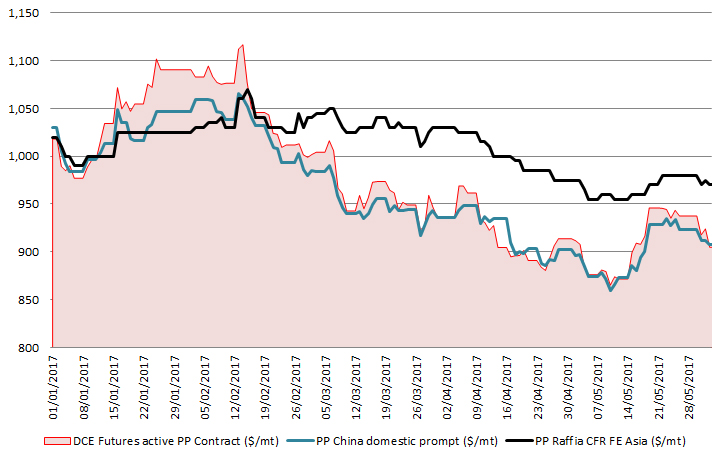

Chart: China polypropylene prices fall as February futures surge abates

Source: Dalian Commodities Exchange, Platts

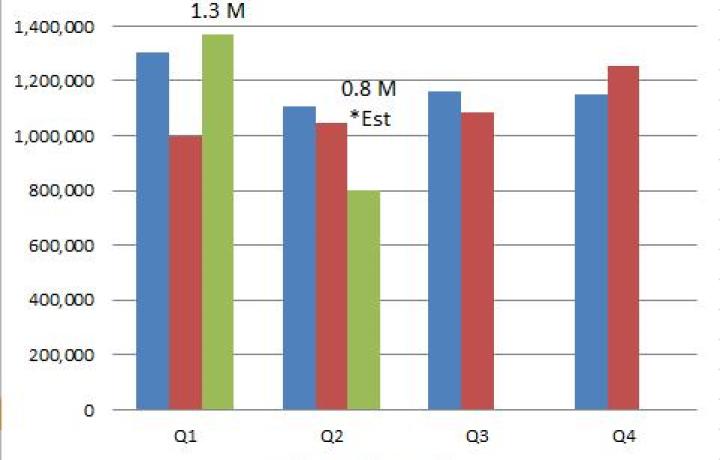

“As we have seen a historically high import level in Q1 into China this year, we expect the net imports to tamper down for the rest of the year. We estimate the [PP] imports to average at around 800,000-900,000 mt per quarter as new start-ups also add more product in the domestic markets later in the year,” said Eshwar Yennigalla, an analyst at Platts Analytics.

“China’s PP demand is still fundamentally GDP-linked, with annualized demand not expected to change drastically. However, demand can be temporarily shifted, based on non-fundamental factors such as futures [surge] as seen in Q1,” a trader from Zhejiang Future said.

After the Dalian Commodities Exchange PP futures rose 12% from the start of the year to $1,117/mt on February 14, China’s Q1 PP imports surged 37% year on year to about 1.4 million mt, as international producers from the Middle East, Asia, and the US, ramped up exports to China to capitalize on the windfall.

But as Chinese authorities stepped in to reign in excessive speculation in the financial markets, futures began to soften, a trader said.

By June 2, PP futures collapsed 16% from its February highs, while the China domestic PP raffia dropped 14%, according to the DCE and Platts data.

The Platts CFR Far East Asia PP raffia price fell a relatively mild 9% since February 14 to $970/mt on June 2, as producers redirected cargo away from China to more profitable markets such as Vietnam in Q2.

Chart: China quarterly polypropylene imports to fall H2 2017 (mt)

Source: China Customs

Meanwhile, China’s PP imports decreased sharply in April, with the homopolymer grade falling 28% month on month to 235,000 mt and the copolymer grades falling 32% to 106,000 mt over the same period, according to China customs data.

Industry sources estimate China’s Q2 and Q3 PP imports to be 30% less than Q1 imports.

EXPORT SECTOR END-USERS MAY LEAD TO Q4 REBOUND

Q4 PP demand outlook is split between optimistic, export-oriented downstream factories, and bearish, domestically focused end-users.

“Finished goods exporters have been keeping inventory at the factory floor at normal levels because export business is improving. Domestic [facing] end-users such as the BOPP segment, however, have seen margins eroding and are keeping their inventories low,” a trader from Grand Petrochemical said.

A large BOPP domestically oriented end-user has confirmed a reduction in raw material stocks from a normal level of about one week down to three-four days in Q2 due to poor demand.

“PP prices should bottom out in July, and may rebound in late-Q3 or early-Q4. October-to-December tends to be the peak polymer demand season, as the household appliances, electronics, and dry-goods sectors prepare for the year-end holidays,” a Sinopec manager said.

Meanwhile, producer’s inventory has been quietly falling from February’s peak to a normal range of about 750,000 mt in early-June, the source added.

“We lowered our inventory to a reasonable level and expect to be able to maintain normal levels for the second half of the year,” he said.

Earlier in February, China’s producers’ inventory hit a multi-year high of 1.06 million mt, even as futures prices peaked, surpassing the 2015 and 2016 annual highs of 1.04 million mt and 1.05 million mt, respectively, traders said.

Table: 2017 polypropylene startups

Source: Industry

As the pace of domestic China PP startups moderate, international imports slow down, and domestic producer’s inventories are drawn down, China’s polypropyleneprices may rebound in Q4, if the downstream export sector takes off.