SINGAPORE (ICIS)–Asia’s spot butadiene (BD) price gains appear to be losing momentum as buyers have retreated to the sidelines amid extreme volatility in the key Chinese market.

“Customers now wait as there are several cargoes still available for second-half July, and we expect the Chinese domestic BD prices to fall later in second-half July, which will put pressure on the US dollar import price,” a trader said.

“Spot offers for second-half July cargoes at $970/tonne CFR (cost and freight) NE (northeast) Asia have seen little buying interest from the downstream synthetic rubber makers,” he said.

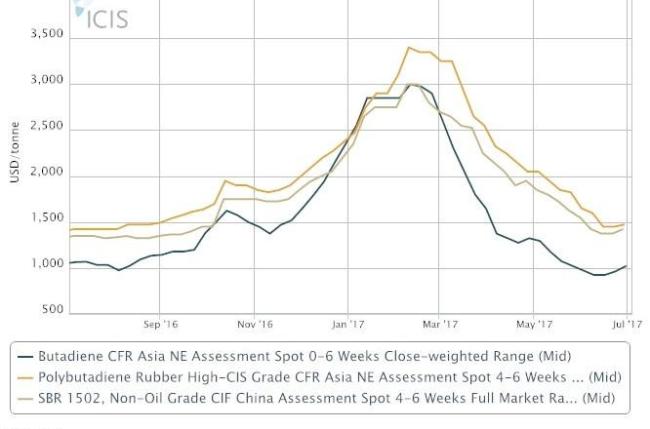

On 30 June, prices gained for the second consecutive week to $1,025/tonne CFR NE Asia, with a cumulative increase of $100/tonne after plunging by 70% since February, according to ICIS data.

“The BD uptrend is not sustainable as the downstream producers do not support it,” a downstream synthetic rubber producer said.

Market players in Asia have turned more cautious in light of the market volatility in the first half of this year, and are closely monitoring price adjustments of Chinese BD producers.

Chinese petrochemical major Sinopec hiked on Tuesday its domestic BD offers by yuan (CNY) 500/tonne to CNY8,500/tonne ex-works, while another local producer Liaoning Huajin Tongda Chemical maintained its offers this week at CNY8,810/tonne.

On 3 July, domestic BD prices in east China stood at CNY9,000-9,100/tonne ex-works, up 18.3% from mid-June, according to data compiled by the China editorial team at ICIS.

But regional players are wary about price movements in China, where price spikes can be reversed quickly, sometimes, in the same week.

“Demand will be the key factor that will determine the BD price trend. The Chinese domestic BD price movements tend to be erratic and do not reflect the market fundamentals,” an Asian BD producer said.

BD’s major downstream market is synthetic rubber, which goes into the manufacture of tyres for the automotive industry. Other derivative markets include acrylonitrile butadiene styrene (ABS).

Some market players expect BD demand to improve in August, when the tyre makers start replenishing their synthetic rubber stocks.

“The BD price trend also depends on sentiment, whether crude oil or natural rubber price will continue to go up,” another trader said.

The uptrend is not sustainable amid ample regional supply and as downstream synthetic rubber price gains were lagging behind those of their feedstock, a downstream producer said.

Downstream styrene butadiene rubber (SBR) and polybutadiene rubber (PBR) prices tend to move in tandem with those of rival tyre feedstock natural rubber (NR).

Non-oil grade 1502 SBR prices on 28 June increased $50/tonne week on week to $1,425/tonne CIF (cost, insurance and freight) China, while high-cis PBR prices rose $25/tonne week on week to $1,475/tonne CFR NE Asia on 29 June, ICIS data showed.

SMR20 tyre grade NR price closed at $1,550/tonne on 3 July at the Malaysian Rubber Exchange, up by $100/tonne from the June average.

Focus article by Helen Yan

($1 = CNY6.80)

Additional reporting by Alex Feng and Judith Wang

Picture: Butadiene (BD) is a raw material used in the production of synthetic rubbers, which go into tyres for the automotive industry. (Source: WestEnd61/REX/Shutterstock)

By Helen Yan