Third, from the situation of the three major U.S. automobile manufacturers (GM, Ford, Chrysler), the three major car dealers 2012 production was the general upward trend. The three car dealers, car production share of U.S. auto production rose more than 80%, accounting for up to 89.5% in 2011. As of November 2012, the production increase, the largest Chrysler rose, up 21.37%; GM and Ford rose 5.1% and 3.9% respectively.

Figure 28: The three major U.S. car manufacturers production (units: vehicles)

Source: WIND Securities Futures Research Department

Looking ahead, based on the optimistic expectations of our macro group of U.S. economic growth, we believe that the U.S. auto market in 2013 to continue to maintain a good momentum of recovery is a high probability event, but the government and the personal sector deleveraging will weaken this process. U.S. car sales growth and GDP growth has a linear relationship, based on our macro group on the expected level of 2.3% of the U.S. economy, we estimated that the the 2013 automobile consumption in the United States will return to the level of 1500-1600 ten thousand, in the car in the next 1-3 years sales are expected to return to a level of 16 million, the proportion of U.S. auto production will continue to improve.

5.1.1.2. European car market situation analysis

From the development of structural analysis, we believe that the trend of European automobile market and the manufacturing sector PMI new orders index showed positive correlation.

Phased June 2008, the manufacturing PMI fell below 50%, to April 2009, the European manufacturing PMI has been in a less than 40%, the lowest level in seven years, and nearly 20% decline in European car registrations for the same period . European manufacturing industry in the second half of 2009 showed a relatively strong recovery momentum, manufacturing PMI for the first time in October of the same year a return to the Coorong online, by 50.7%, to February 2011, the highest value of 59%, seasonally adjusted European new car registrations in March value of 95 or more. Since then, the manufacturing PMI and new orders both moving lower, European manufacturing PMI data as of November 2012 was 46.2%, the number of new orders presented negative. Compared the same period in the automobile market situation, the 2010 European car sales fell 4.9% year-on-year, to 13.8 million, in stark contrast with the same period in the global auto market growth rate of 25%.

Figure 29: European PMI manufacturing new orders (unit:%)

Figure 30: European car registrations seasonally adjusted

Source: WIND Securities Futures Research Department

From the current analysis, we believe that the downturn trend in the European automobile market in 2012.

The global automotive market recovered in 2010, with the exception of the European market distressed and still no signs of improvement in 2012.European new car registrations data show that from January to November, passenger cars, commercial vehicles, the average monthly registrations fell by 7.02% and 9.91% respectively. Reference to past changes in the market trends, our initial estimates, annual new car registrations in Europe decreased by about 10% year-on-year in 2011, will increase by 6.5% this year, global automotive production runs counter to.

By country car sales in Germany, France, Britain and Italy, respectively, accounting for 23.6% of the total car consumption in the European region, 16.03%, 16.52% and 10.8% respectively, can be seen as a microcosm of the European automobile market changes. Overall car sales in four countries and new car registrations in 2012 showed a certain degree of weakness, the countries auto market analysis can be found in the following characteristics:

2012 German auto industry contraction, compared to France, Italy and more stable.

From the German manufacturing performance, began in July 2012 in German manufacturing PMI rebounded slightly, to the German PMI for November was 46.8, while the euro zone to 46.2, the German manufacturing performance was slightly stronger than the euro zone PMI.

From automobile production and sales data in Germany, the German car production and sales in 2012 year-on-year decline. January to November, the German car production and sales compared to the same period in 2011 decreased by 7.3% and 2.1%. We believe that, in the context of the European debt crisis and the European market as a whole has shrunk, compared to the European passenger car overall 9.9% decline in 2012, the overall decline of the German car market is relatively small, a more stable form of.

Looking ahead to 2013, we believe that the overall decline of the German new car market sales could reach 6.5%, or 2.9 million, while car sales are expected to be flat this year.

Figure 31: German auto production and sales volume (units: vehicles)

Figure 32: Germany Manufacturing PMI

Source: WIND Securities Futures Research Department

The British automobile market in 2012 a slight growth.

Manufacturing PMI data from the UK and the euro zone PMI data comparison, the situation in the UK manufacturing sector overall compared with the overall trend in the euro area, consistent, slightly better performance degree. 2011 the beginning of the debt crisis in Europe, the British car production 1,344,810, an increase of 5.8%, higher than the 3.2% growth rate of the global automotive market.

See ,1-passenger car sales in November rose 5.43%, to 1,921,052 units; passenger car sales up by 11.74% to 3,579 vehicles; trucks sales only fell 5% to 265,959 vehicles from the 2012 British car data. From the monthly data, we found that the UK new car registrations have very obvious seasonal peak in March September. Car registrations in March 2012 and in September year-on-year growth of 0.8% to 7.3% in January-November average monthly year-on-year growth of 4.3%, indicating that the development of the British automobile market better.

Looking ahead, we believe that, despite the drag of the European debt crisis still exists, but the British auto market a slight advantage due to their own, making 2012 the situation slightly optimistic compared with other European countries. Initially, we expected that the overall automobile market in 2012, or 1-2% gain.

Figure 33: UK manufacturing PMI

Figure 34: UK new car registrations (units: vehicles)

Source: WIND Securities Futures Research Department

In 2012, the French automotive industry is growing in the doldrums, the latter situation is more worrying.

From the development of structural analysis, we found that after 2010, the French auto industry contraction, reflected in the overall downward trend in new car registrations in 2009-2012. See phased in 2009, the French car industry is relatively boom; growth slowed in 2010, car sales fell 5%, the sales volume of less than 2.2 million. French car production in 2011 was 2,000,000, accounting for only 3% of global output.

Data compared with the same period in new car registrations in the ring than motor vehicles, trailers and semi-trailer manufacturing index both changes in trend analysis, from the status quo. French automobile manufacturing in 2012 year-on-year data dropped to below zero, the ring than the end of October 2012, the French motor vehicles, trailers and semi-trailer manufacturing index, dropped to -4.75% and -16.02%, respectively, year on year. Car sales drop 13.8% to 1,738,446 units in January-November 2012, cumulative sales decline for 11 consecutive months.

Looking ahead, we predict that France in 2012 sales will decline 10%, the level of less than two million. The growing trend of contraction of the French automobile market with the debt crisis, and no signs of improvement in the short term. Is expected that by 2015, the French car production will be reduced to 2% share of the global share,

Figure 35: France, motor vehicles, trailers and semi-trailer manufacturing index (unit:%)

Figure 36: French car registrations (unit: vehicles)

Source: WIND Securities Futures Research Department

Italy in 2012, the decline in the automotive industry is very obvious, is expected to post difficult changes.

From the development of structural analysis, the higher levels of the Italian car market downturn. One hand, reflected in the 2009 Italian manufacturing PMI trend a long period under the euro zone manufacturing PMI.The other hand, is reflected in the Italian car ownership growth is slowing down to 2011, the growth rate of ownership is less than 1%, car sales of about 160 million, lower than the mean of 4 years.

Analysis from the status quo, the Italian car market is in deep crisis.Compared to the same period in 2011, new car registrations in Italy in 2012 decreased by 18%, from the registrations ,1-Italian new car registrations in November fell 19.72% to 1,314,868 vehicles.

Looking ahead, we believe that the Italian market in 2013 remains difficult changes.

Figure 37: Italy Index

Figure 38: Italian car registrations (units: vehicles)

Source: WIND Securities Futures Research Department

Figure 39: Italy car ownership (unit: quantity)

Source: WIND Securities Futures Research Department

Late outlook, based on our macro group of the European economy is expected to resume moderate growth expected, we think that the European auto market overall probability has formed a bottom.

To the infinite amount of sterilized debt purchase plan to help restore market confidence, and the EU signed a free trade agreement with Japan, the overall car market in Europe in 2013 or suspend continue in a downward direction. Therefore, I judge that the European auto market in the next two years the Reduce drag on the extent of the global auto market.

5.1.2. Emerging countries in the development of the automotive industry situation

Analysis from the development stage, the emerging markets, the automotive industry has experienced from low speed to high speed, to the stage of stable development.

Phased look from 2000 to 2006, emerging markets accounted for less than 20% of the global passenger car market share to lower the pace of development and limited influence on the global auto market. In 2010, the global automobile market is entering a recovery phase, mainly driven by emerging market countries. For example, China’s vehicle production in 2010 increased by 32.6%, the total output of the first in the world; Brazilian automobile production in 2010 increased by 11.9%, to become the fourth-largest auto market. The resulting direct result of the emerging national car market share in 2011 rose to 51%, but the growth rate declined in 2012.

From the current analysis, we believe that emerging markets slightly smooth stage in the rapid development of the automobile market.

The reason why the pre-car sales in emerging markets rapid growth, we believe that on the one hand because of the large-scale consumption potential of emerging markets, overall economic trends, on the other hand, due to the emerging market countries, the introduction of stimulus automobile production and sales role in promoting. For example, China’s energy-saving car subsidy policy and small displacement car purchase tax incentives, which greatly stimulate automobile consumption. Brazil, relaxed credit system makes about 16% of Brazilian consumers to be able to afford to buy a new car, after the proportion was only 10%.

Looking ahead, we believe that emerging markets in the financial crisis will again show a relatively high-speed growth pattern is expected late in China, India, Brazil and Russia will dominate the world’s major auto market.According to the LMC the emerging national car market share in 2015 is expected to reach 55%.

Figure 40: Global passenger car sales and emerging market share (units: one million)

Source: LMC Automotive Forecasting in the Futures Research Department

5.1.2.1. China’s auto industry development

Analysis from the stage of development, the rapid development of China’s automobile industry, the average annual growth rate of more than 25% in the years 2001-2011, only 2008 and 2011, the growth rate of less than 5%. Began in 2011, China’s auto industry is slowing down, the same period in the production and sales increased by only 0.8% and 2.5%, respectively, in 2005, the growth rate to low.

From the period of performance of the automobile production and sales, we found in China’s auto market consumption season in 1,3 months each year and the fourth quarter the seasonal auto consumption off-season of the year usually in February, July saw the lows.

Figure 41: China’s auto output (Unit: million)

Figure 42: Chinese car sales (units: volume)

Source: Research Department of the China Association of Automobile Manufacturers in the Futures

Analyze automotive consumer type performance, we found that passenger car sales the highest proportion of the total automobile production and sales. 2005 to 2008, the proportion of passenger cars and commercial vehicles were 75%, 25%; 2009, passenger car sales accounted for more than 80% compared to commercial vehicles accounted enhance more limited.

Figure 43: China’s auto production (units: vehicles)

Figure 44: Chinese car sales (units: amount)

Source: Research Department of the China Association of Automobile Manufacturers in the Futures

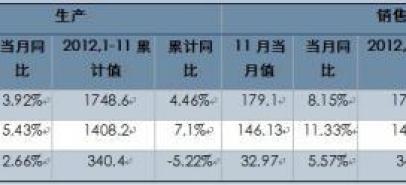

Analysis, 2012, China’s automobile market is still showing steady growth. January to November 2012, the National Automobile amount of production and sales, respectively, 17,486,200 and 17,493,500, an increase of 4.46% and 3.86%. The sales of slightly more than the production in the auto companies continue to reduce production, lower than the actual market sales, the inventory problem is expected to be eased gradually. Nov. single month sales ring growth exceeded 10%, the same as in previous years, the trend, in line with the laws of the seasonal consumption season.

The sub-models look, 2012 the first 10 months of commercial vehicle production and marketing chain has been in negative growth in November commercial vehicle production and marketing chain growth, but as a positive signal, means that the auto recovery is more support. Market segments, the concern is that the SUV market, November, sport utility vehicles (SUV) sold 189,200, a growth of 15.23% year-on-year growth of 18.02%; sport utility vehicles in January-November (SUV) sales of 1,793,300, an increase of 26.26%.

Figure 45: Chinese car production data for November 2012 (Unit: million)

Source: Research Department of the China Association of Automobile Manufacturers in the Futures

Looking ahead, based on our macro group expected volatility on the bottom of the Chinese economy, we expect in 2013, the Chinese auto market this modest trends will continue, automobile production and sales growth rate of about 4-8%. The model point of view, SUV or will become a major driver of growth in the future of passenger cars.

Translated by Google Translator from http://market.cria.org.cn/20/12122_3.html

Read more:

- 2013 natural rubber investment strategy report (part 1)

- 2013 natural rubber investment strategy report (part 2)

- 2013 natural rubber investment strategy report (part 4)

- 2013 natural rubber investment strategy report (part 5)