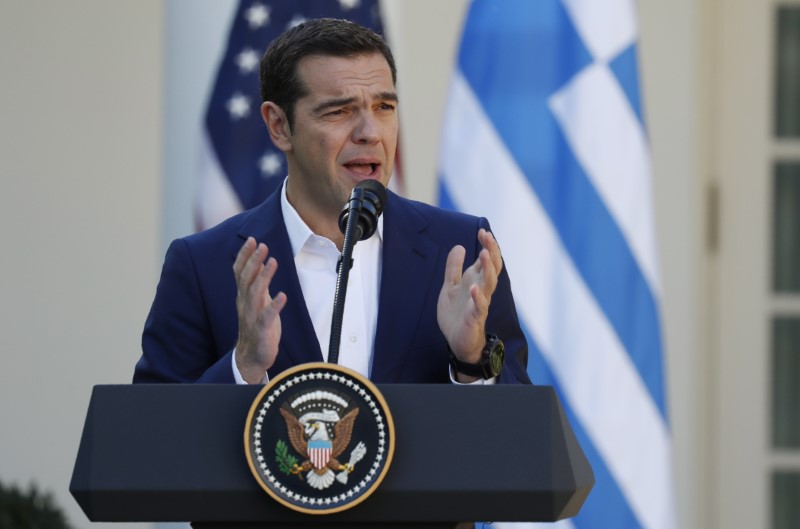

© Reuters. Greek Prime Minister Tsipras speaks as he holds a joint news conference with U.S. President Trump at the White House in Washington

© Reuters. Greek Prime Minister Tsipras speaks as he holds a joint news conference with U.S. President Trump at the White House in WashingtonATHENS (Reuters) – Greece expects to beat creditors’ projections and achieve a higher primary surplus this year and buoyant growth in 2018, authorities said, as lenders moved forward on “constructive” talks on bailout reforms.

With its economic performance under the close scrutiny of lenders who have extended billions to the indebted country, outperforming budget targets is crucial for Greece, which has a huge debt and has been struggling to fix its fiscal woes for seven years.

“We will close this year with the number 2 in front (of the growth rate) and next year we will prove the Cassandras wrong, 2018 growth could be close to 3.0 percent,” Prime Minister Alexis Tsipras told parliament on Friday.

Greece has seen nascent growth in the past year from a resurgence of tourism and a pick-up in domestic demand after a crisis which sapped more than a quarter of the country’s output.

Its latest growth projections and the central bank see the economy expanding by 2.4 percent next year. The government forecasts a 1.8 percent expansion in 2017 – a little below Tsipras’ estimate to parliament.

A Finance Ministry official said authorities expected to turn in a budget surplus of 2.8 percent of economic output, beating an earlier forecast of 2.2 percent and a 1.75 percent target in its bailout program.

The leftist-led government says it plans to spend part of its surplus on a cash-buffer for the post-bailout era. It also expects to have fully regained access to bond markets by next August, when the program ends.

But the biggest part of the surplus will be distributed to poor Greeks who have suffered during the crisis, government officials have said. It is not yet clear who would be eligible for what the government calls a “social dividend”.

The issue will be discussed with the lenders, who are expected to return to Athens for another round of talks next month, aiming to wrap up the review by December.

“Good and constructive discussions” were held, a representative of the lenders said. Technocrats assessing Greece’s performance will return in the last week of November.

As part of reforms, Athens is required to submit a road map on how it will open up its gas market and has yet to agree with the lenders which coal-fired plants will be put up for sale.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com