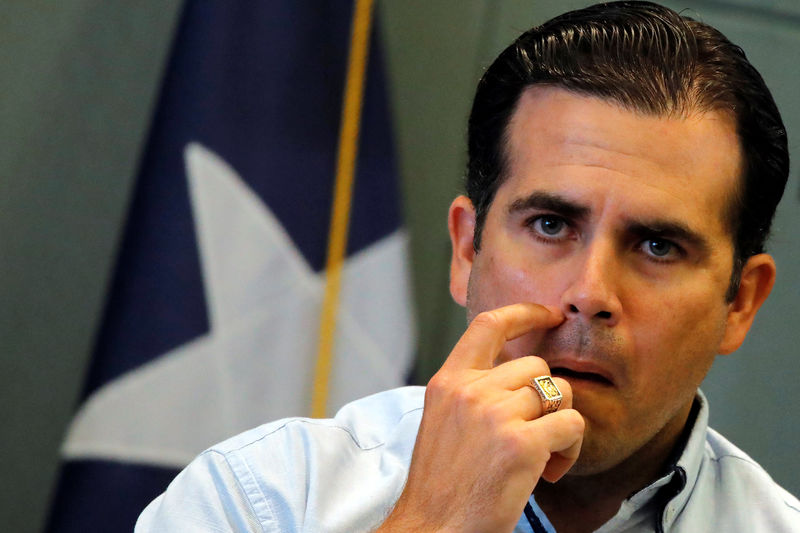

© Reuters. Governor of Puerto Rico Ricardo Rossello attends a news conference days after Hurricane Maria hit Puerto Rico, in San Juan

© Reuters. Governor of Puerto Rico Ricardo Rossello attends a news conference days after Hurricane Maria hit Puerto Rico, in San JuanBy Ginger Gibson and David Gaffen

WASHINGTON/NEW YORK (Reuters) – Puerto Rico Governor Ricardo Rosselló wants to cancel a tiny Montana company’s $300 million contract to restore power to the storm-hit U.S. territory and expects help from the governors of Florida and New York, his office said on Sunday.

Whitefish Energy Holdings’ contract with Puerto Rico’s bankrupt power utility has come under fire after it was revealed that the terms were obtained without a competitive public bidding process.

Criticism increased after a copy of the contract with the Puerto Rico Electric Power Authority surfaced online on Thursday night and raised more questions, particularly over language blocking oversight of costs and profits.

Whitefish officials have said they secured the deal legitimately and would not oppose an audit of the company’s work. A Whitefish spokesman could not immediately be reached for comment after Sunday’s announcement.

Whitefish, which has a full-time staff of two people, says it has now more than 325 people on the island working to restore power.

The Puerto Rico Energy Commission is reviewing all of PREPA’s actions, including its contracts, but has not spoken with the governor, interim head Jose Roman said in an interview on Sunday.

Several weeks after Hurricane Maria hit Puerto Rico, about 75 percent of homes and businesses still lack electricity. Rosselló said he hoped that 30 percent of power would be restored to the island by the end of October.

“Following the information that has emerged, and with the goal of protecting public interest, as governor I am asking government and energy authorities to immediately activate the clause to cancel the contract to Whitefish Energy,” Rosselló said in a statement to reporters.

He said he had reached out to Florida Governor Rick Scott and New York Governor Andrew Cuomo to seek help in replacing Whitefish and that they were prepared to assist in restoring power.

“I have given instructions to immediately proceed with the necessary coordination with the states of Florida and New York, in order for brigades and equipment to arrive on the island,” Rosselló’s statement said.

Scott and Cuomo’s offices did not immediately respond to requests for comment.

The Puerto Rican government is bracing for the possibility that Whitefish would sue for breach of contract if the cancellation is approved, according to sources familiar with discussions. The government already paid Whitefish $8 million and does not expect the U.S. Federal Emergency Management Agency to reimburse that sum, the sources said.

Rosselló said he had requested an investigation into how the contract between PREPA and 2-year-old Whitefish was decided upon so quickly.

The contract and the slow restoration of power on the island have raised questions about the management of PREPA’s response to Maria.

It took about a week for PREPA to complete a damage assessment while residents were relying on diesel generators and most of the island remained in darkness.

Whitefish spokesman Ken Luce had said the deal was secured when the company’s chief executive officer and co-owner, Andy Techmanski, flew to Puerto Rico on Sept. 26, six days after Maria tore into the island.

PREPA had been in contact with Whitefish following Hurricane Irma, which did less damage to the island, in a formal bidding process that was not completed because Maria had hit. There was no formal bidding process after Maria, Luce said, but he termed the contract in “good faith” and “fair” to PREPA.

Whitefish, named after the Montana town where it is located, briefly got into a fight on Twitter last week with San Juan Mayor Carmen Yulin Cruz, who criticized the lack of transparency in the deal. The company threatened to leave the island before apologizing.

Puerto Rico’s financial oversight board earlier this week said it would appoint an emergency manager to oversee PREPA, but Rosselló resisted that idea.

PREPA has a $9 billion debt load caused by years of unsuccessful rate collection efforts, particularly from municipal governments and state agencies, and a lack of investment in equipment and maintenance.

Source: Investing.com