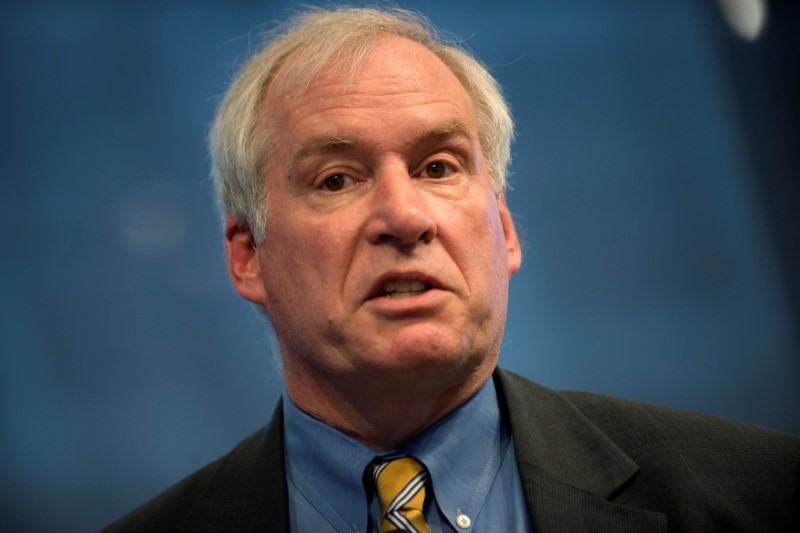

© Reuters. File Photo: The Federal Reserve Bank of Boston’s President and CEO Eric S. Rosengren speaks in New York

© Reuters. File Photo: The Federal Reserve Bank of Boston’s President and CEO Eric S. Rosengren speaks in New York2/2

BOSTON (Reuters) – Falling unemployment and sustained growth mean the U.S. economy has accelerated beyond a sustainable level so the Federal Reserve should continue to raise interest rates, including next month, a veteran Fed policymaker said on Wednesday.

Boston Fed President Eric Rosengren, whose recently hawkish views have reflected the U.S. central bank’s policy tightening over the last year, said “temporary factors” are behind the below-target inflation readings.

The Fed’s preferred price measure has lingered below a 2-percent target for five years and is now at 1.3 percent. Unemployment has fallen to 4.1 percent, down from a crisis-era high of 10 percent, while overall economic growth is running strong at 3 percent.

“It is quite likely that unemployment will fall below 4 percent, which is likely to increase pressures on inflation and asset prices,” said Rosengren, who does not have a vote on the Fed’s policy-setting committee until 2019 under a rotation.

“That suggests the need to continue to gradually remove monetary policy accommodation, which is quite consistent with market expectations of another increase in December,” he added at a Northeastern University economics forum.

The central bank has raised rates twice this year and faces a leadership overhaul next year when Fed Chair Janet Yellen and New York Fed President William Dudley expect to step down. Rosengren is among only a few top policymakers who held their current jobs during the depths of the 2007-2009 financial crisis.

In a speech that largely repeated past comments, he said the economy seems to have moved beyond the point of “maximum sustainable employment” in recent quarters.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com