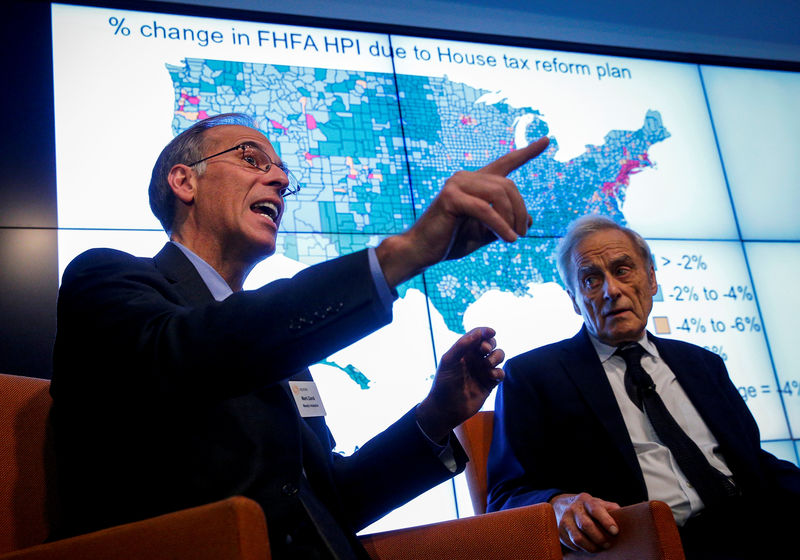

© Reuters. Mark Zandi, chief economist of Moody’s Analytics, participates in a Reuters Newsmaker panel on ‘The Trump Budget Debate’ in New York

© Reuters. Mark Zandi, chief economist of Moody’s Analytics, participates in a Reuters Newsmaker panel on ‘The Trump Budget Debate’ in New YorkBy Daniel Trotta

NEW YORK (Reuters) – Billionaire entrepreneur and potential presidential candidate Mark Cuban said on Wednesday that a cut in the U.S. corporate tax rate would have little to no effect on his investment decisions.

Bills before both the U.S. Senate and the House of Representatives would cut the corporate rate from the current 35 percent to 20 percent.

President Donald Trump and other supporters of the tax cut bills say reducing corporate and other taxes would boost the U.S. economy by freeing up capital that would be invested in job-creating industries.

But Cuban said the tax rate had zero impact on decisions whether to invest in small businesses, as he does through the reality show “Shark Tank,” and almost no effect on decisions for his own lineup of tech and entertainment companies.

“Competition drives what I do in my businesses a whole lot more than tax rates,” Cuban told a Reuters Newsmaker forum entitled “The Trump Budget Debate” and moderated by Reuters Editor-at-Large Harry Evans.

“Amazon (O:) is going to affect a whole lot more companies and futures, as will Microsoft (O:) and Facebook (O:) and Google (O:) and other big companies, a lot more than a marginal tax rate,” Cuban said.

Economists who joined Cuban on the panel also disputed the traditional conservative or supply-side argument behind tax cuts.

Alan Blinder, a Democrat and former vice chair of the Federal Reserve’s board of governors, said data going back decades have failed to show a correlation between tax rates and subsequent growth.

Mark Zandi, a Democrat and chief economist at Moody’s Analytics, said “taxes matter” and that well-constructed tax policy can improve long-term growth but not nearly as much as the assumptions made by the Trump administration. In any case, Zandi said, the House and Senate proposals were “very bad tax policy.”

Dambisa Moyo, a Zambian-born global economist, said technology, demographic shifts such as immigration, and debt have far more impact than do taxes on growth.

Cuban argued that the best tax cut to spur growth would be employment tax reduction such as the 2-percentage-point payroll tax reduction that former President Barack Obama signed in 2010.

Employment taxes are paid both by workers, via withholdings from their wages, and by employers.

Cuban, 59, a onetime supporter of Trump who later endorsed Democrat Hillary Clinton in the 2016 presidential campaign, has told interviewers since early October that he is considering his own presidential run in 2020.

Asked about it by a member of the audience on Wednesday, he responded, “I don’t know yet.

“It’s a serious decision and it’s not one I have to make today,” Cuban said.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com