SINGAPORE (ICIS)–Styrene butadiene rubber (SBR) prices in Asia are facing downward pressure in the near term from continued price weakness of rival product natural rubber (NR) and slumping values of feedstock butadiene (BD).

“It is a buyers’ market. Buyers are waiting for the SBR price to drop to around or below $1,500/tonne [CFR SE Asia] due to the weak NR and feedstock BD decline,” a trader said.

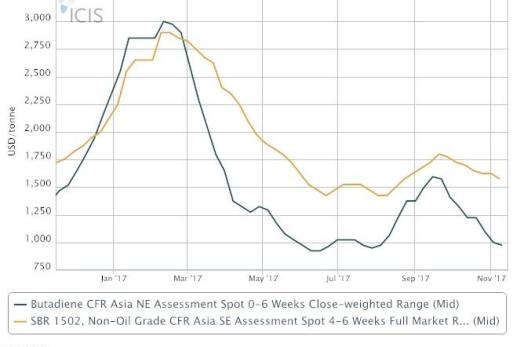

On 8 November, weekly SBR non-oil grade 1502 prices were assessed at $1,550-1,600/tonne CFR (cost and freight) southeast (SE) Asia, down by $150/tonne from early October, ICIS data showed.

NR prices, on the other hand, have continued to weaken this week. At midday, SMR 20 tyre grade NR stood at $1,388/tonne FOB (free on board) Malaysia at the Malaysian Rubber Exchange, down from the October average of $1,445/tonne FOB Malaysia.

NR and SBR are competing feedstocks in the production of tyres for the automotive industry and their prices tend to impact each other.

Sluggish demand from the downstream tyre makers is also weighing down on regional SBR prices.

“Tyre makers are adopting a cautious stance in light of the bearish sentiment and unwilling to build up their [SBR] inventories towards the fiscal year end,” a supplier said.

But major Asian SBR makers are unwilling to lower their SBR 1502 prices in spite of the recent plunge in BD prices, citing a margin squeeze.

On 10 November, spot BD prices were assessed at $975/tonne CFR NE Asia, down by 26% from 6 October, ICIS data showed.

“The feedstock BD cost was much higher in October, so we cannot drop the SBR 1502 price below $1,550/tonne CFR SE Asia or we will have no margins,” an Asian SBR maker said.

Focus article by Helen Yan

Picture: Electric car assembly line n Zhejiang, China. Styrene butadiene rubber (SBR) is a raw material for the production of tyres for the automotive industry. (Source: Imaginechina/REX/Shutterstock)

Picture: Electric car assembly line n Zhejiang, China. Styrene butadiene rubber (SBR) is a raw material for the production of tyres for the automotive industry. (Source: Imaginechina/REX/Shutterstock)