(Bloomberg) — The Old Mutual Gold & Silver Fund, which manages $220 million of mostly precious metal equities, is jumping on the bitcoin wagon.

The fund started buying in April with a mandate to allocate as much as 5 percent to cryptocurrencies, according to its manager, Ned Naylor-Leyland. The idea is to take profits from bitcoin as it advances to reinvest in gold and silver assets, he said in an interview on Nov. 16.

“Bitcoin was explicitly designed to be digital gold,” said Naylor-Leyland. “So if you’re going to have a small proportion of a fund in bitcoin, it should be in a gold fund, because that’s exactly the point. It’s about bringing the ownership of disciplined money into the modern world. Bitcoin is paving the way for the reintroduction of gold as global money.”

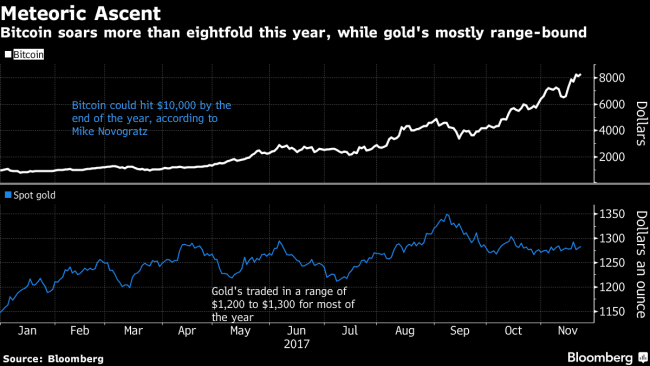

Bitcoin’s up more than eight times this year to top $8,000 as entrepreneurs in the field say its value lies in proof of concept for a new kind of payment system not reliant on third parties like governments, big banks or credit-card companies. By contrast, gold’s held in a tight range since February, with a short break upward in September as U.S. and North Korea tensions spiraled.

For a QuickTake on bitcoin and blockchain, click here

The virtual currency has many backers and detractors. Mike Novogratz, who’s starting a $500 million hedge fund to invest in such assets, said bitcoin will likely end the year at $10,000. Standpoint Research’s Ronnie Moas on Monday raised his 2018 price target for the second time this month, to $14,000 from $11,000. But Goldman Sachs Group Inc (NYSE:). last month said gold wins out over cryptocurrencies when assessed on most of the key characteristics of money.

and blockchain resolve gold’s problems of divisibility, ownership and speed of transmission, said Naylor-Leyland, who’s investing through a Swedish-listed exchange-traded fund. “We’re going to revert to sound money,” he said. “If you imagine sound money and blockchain together, there’s quite an exciting potential outcome.” His fund has about 80 percent in gold and silver equities and most of the rest in physical metal.

Bitcoin traded at about $8,240 as of 10:55 a.m. in Singapore on Thursday, some $130 short of its record on Tuesday. was at $1,290 an ounce.

(Updates with prices in final paragraph.)

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com