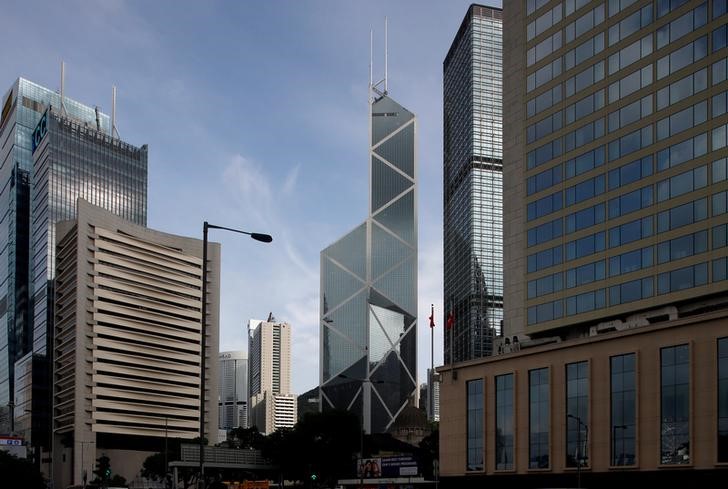

© Reuters. FILE PHOTO: The Bank of China Tower is seen at the financial Central district in Hong Kong

© Reuters. FILE PHOTO: The Bank of China Tower is seen at the financial Central district in Hong KongBEIJING (Reuters) – China will “fully” consider the possible impact on banks and markets before finalizing its new asset management rules, Xinhua news agency quoted a senior banking regulator as saying on Saturday.

China issued draft guidelines last month to tighten rules on the asset management industry, the latest step by Beijing to fend off systemic risks from the country’s rampantly growing shadow banking sector.

“The new regulations will fully consider the impact on banks and markets before being finalised,” Xinhua quoted Liu Zhiqing, deputy director general of the China Banking Regulatory Commission’s prudential regulation bureau, as saying.

“We are seeking comments now, hoping all parties will make suggestions and come up with good solutions that will be implemented smoothly.”

The transition period for the new regulations lasts until June 30, 2019.

Sources have told Reuters that ten Chinese banks have raised strong objections to the central bank’s proposals, saying it may cause a rush of redemptions among other risks.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com