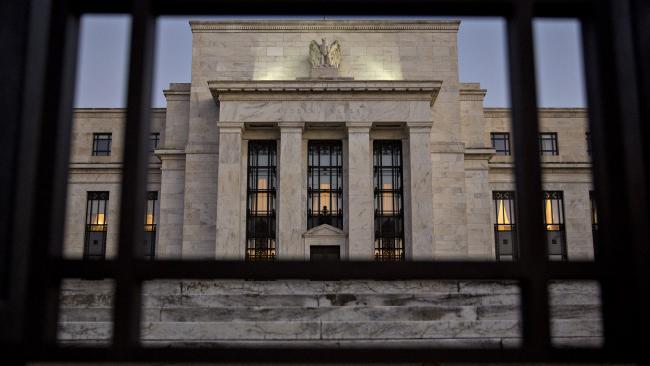

© Bloomberg. The Marriner S. Eccles Federal Reserve building stands in Washington, D.C., U.S., on Friday, Nov. 18, 2016. Federal Reserve Chair Janet Yellen told lawmakers on Thursday that she intends to stay in the job until her term expires in January 2018 while extolling the virtues of the Fed’s independence from political interference.

© Bloomberg. The Marriner S. Eccles Federal Reserve building stands in Washington, D.C., U.S., on Friday, Nov. 18, 2016. Federal Reserve Chair Janet Yellen told lawmakers on Thursday that she intends to stay in the job until her term expires in January 2018 while extolling the virtues of the Fed’s independence from political interference.(Bloomberg) — On the eve of Janet Yellen’s second-last Federal Open Market Committee meeting as chair of the U.S. central bank, before handing over the reins to Jerome Powell, investors are showing the most confidence in nine months toward the prospect of higher interest rates next year.

The spread between January 2018 and January 2019 fed funds futures contract yields, a proxy for how many times rates will be raised next year, widened to half a percentage point on Tuesday for the first time since March, pricing two quarter-point increases. Back in September, investors weren’t even fully pricing a single hike.

Updated FOMC interest-rate projections to be released Wednesday will probably show the median participant on the 16-member committee still expects three quarter-point rate hikes next year, as in September. But there’s a chance that number could move up to four, depending on how optimistic policy makers are feeling about the outlook for economic growth and inflation.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com