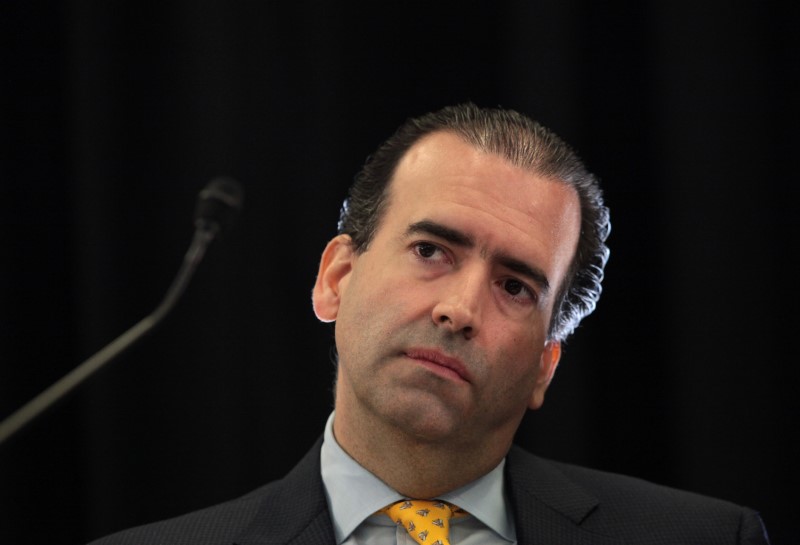

© Reuters. FILE PHOTO: Chairman of Puerto Rico’s fiscal control board Jose Carrion III attends a meeting of the Financial Oversight and Management Board for Puerto Rico at the Convention Center in San Juan

© Reuters. FILE PHOTO: Chairman of Puerto Rico’s fiscal control board Jose Carrion III attends a meeting of the Financial Oversight and Management Board for Puerto Rico at the Convention Center in San JuanBy Nick Brown

NEW YORK (Reuters) – Puerto Rico’s financial oversight board said on Monday it will probe the sources of some $6.9 billion in cash held by the bankrupt U.S. commonwealth’s government in several bank accounts.

The board’s statement followed a report by the island’s government revealing a total of $6.9 billion held on behalf of a variety of public agencies, including $1.64 billion in a general operating account and $905 million for the island’s sales taxing authority, COFINA.

In its statement, the oversight board criticized Puerto Rico’s financial transparency, noting it has yet to publish audited financial statements for fiscal year 2015.

“It is essential that we improve the transparency and accountability of public finances to put Puerto Rico on the road to economic recovery,” board Chairman Jose Carrion said.

The board would investigate the “sources and uses of the funds, as well as on the nature of their legal restrictions,” and hold a public hearing on the matter in January, the statement said.

The investigation comes as Puerto Rico seeks steep concessions from Wall Street creditors and individual investors on $71.5 billion in debt the island has said it cannot pay.

In May, the U.S. territory filed the largest government bankruptcy in U.S. history, battling a population exodus and near-insolvent public health and pensions systems.

In September, Puerto Rico was rocked by Hurricane Maria. The storm killed dozens of people and leveled infrastructure, and has exacerbated a migration trend to the mainland. It has sent bond prices plummeting, while much of the population remains without power three months after the storm.

Early on Monday, the island’s government issued a summary of account balances for its agencies, part of what it says is an ongoing, five-part “evaluation of financial matters of the government of Puerto Rico.”

The $6.9 billion total also includes $513 million in accounts related to its insolvent public employee pension fund, and a roughly $600 million balance at bankrupt power utility PREPA.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com