(Bloomberg) — Oil’s bull run is grinding to a halt.

Hedge funds lowered their bets on after they rose to a record a week earlier. And the net-bullish position on West Texas Intermediate, which hit a nine-month high last month, dwindled for a third straight week. The message: After a months-long build-up, investors are wavering, concerned will continue to boom in 2018, undercutting OPEC’s push to drain a global glut.

“It seems like now most people have got their positions and are waiting to see what 2018 brings,” said Rob Thummel, managing director at Tortoise Capital Advisors LLC.

Oil futures in New York have jumped almost 40 percent since June as OPEC and its allies extended their production-cut deal and U.S. inventories shrank to two-year lows. But the decline in American stockpiles is largely due to refinery maintenance and exports near an all-time high. Meanwhile gushers in the country are producing at a record pace.

Global stockpiles won’t fall enough to reach the level targeted by OPEC when the group meets in June, Saudi Arabia’s Energy Minister Khalid Al-Falih said last week.

American output is poised to reach 9.99 million barrels a day in May, according to the Energy Information Administration. That would surpass Saudi Arabia’s curtailed production of 9.97 million barrels a day in November.

Net Positions

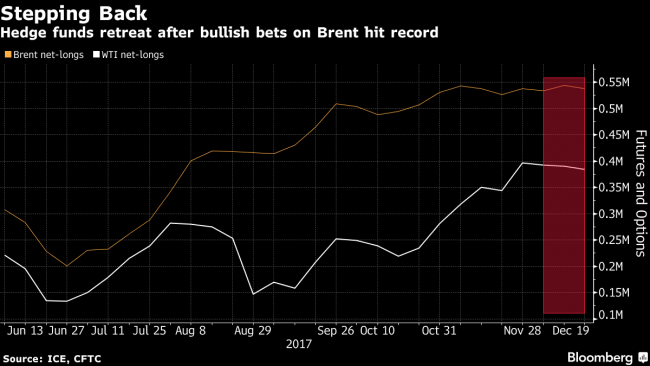

The Brent net-long position — the difference between bets on a price increase and wagers on a drop — fell 1.1 percent to 538,045 contracts in the week ended Dec. 19, according to data from ICE Futures Europe. That’s after reaching a record 544,051 contracts in the previous week. Longs fell 1.2 percent, while shorts decreased 1.8 percent.

Money managers cut their WTI net-long position by 1.8 percent to 383,828 futures and options during the week, according to data from the U.S. Commodity Futures Trading Commission on Friday. Longs fell by 1.2 percent, while shorts rose 3.9 percent.

“It’s been a good year,” but there’s “some worry about what next month is going to bring,” said John Kilduff, founding partner at Again Capital LLC in New York. “There’s not as much enthusiasm about the OPEC/non-OPEC accord as there was even a few weeks ago.”

Pipeline Outage

The North Sea’s Forties Pipeline System, which carries crude used to price the Dated Brent benchmark, is set to return to normal flows early in the new year, according to a statement from operator Ineos Group. The outage, which gave a boost to prices, was the first time a force majeure had been declared in the North Sea since 1988. Repairs are expected to be completed by “around Christmas.”

In the fuel market, money managers reduced their net-long position on benchmark U.S. gasoline by 2.1 percent. Meanwhile, the net-bullish position on diesel rose by 1.9 percent.

Heading into next year, investors will be watching how long it takes to get inventories back to the five-year average, Thummel said. The OPEC deal extension brought some certainty to the market, which is now waiting to see how the cuts and U.S. production play out.

“That was the big cloud overhanging the oil market and prices,” he said.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com