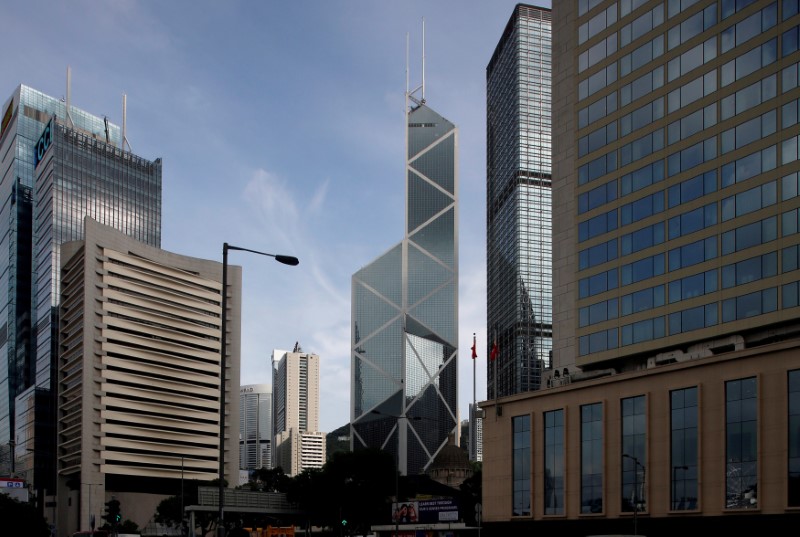

© Reuters. FILE PHOTO: The Bank of China Tower is seen at the financial Central district in Hong Kong

© Reuters. FILE PHOTO: The Bank of China Tower is seen at the financial Central district in Hong KongSHANGHAI (Reuters) – China’s banking regulator will further tighten the screws on the trust industry next year, two sources with direct knowledge of the matter said, as Beijing steps up a campaign to clampdown on the country’s shadow banking sector.

Trusts have been a key part of China’s shadow banking sector, which helps channel deposits into risky investments via products often designed to dodge capital or investment regulations.

The China Banking Regulatory Commission (CBRC) recently told trust firms in Beijing that next year the regulator will take forceful measures to stem the rapid growth of the trust industry, the sources told Reuters.

Trust companies that are reckless and irresponsible will receive maximum punishment if any violations are found, the sources said.

The CBRC did not immediately respond to a Reuters request for comment.

The banking regulator last week banned lenders from using trust firms to skirt regulations and cover up risks.

Outstanding trust assets were at 24.41 trillion yuan ($3.75 trillion) at the end of September, up 34.33 percent from a year earlier, according to data from the China Trustee Association.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com