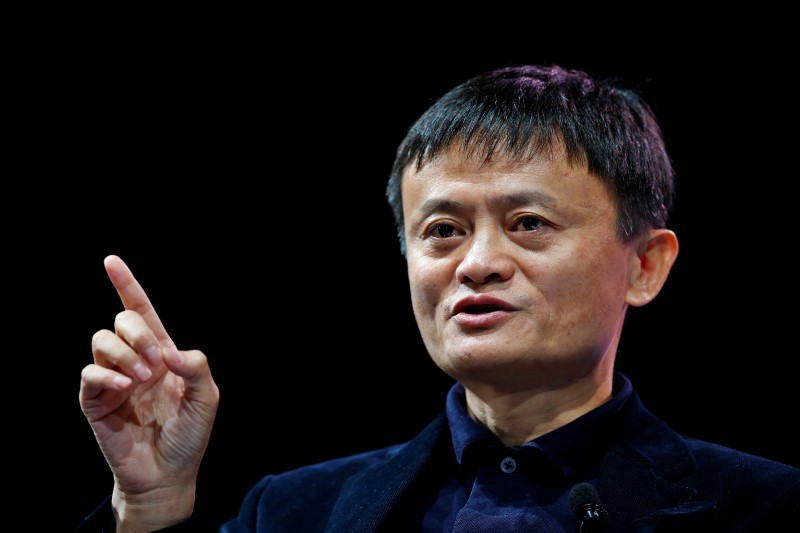

© Reuters. Alibaba’s Jack Ma Will Consider Listing Units in Hong Kong

© Reuters. Alibaba’s Jack Ma Will Consider Listing Units in Hong Kong(Bloomberg) — Alibaba (NYSE:) co-founder Jack Ma will consider floating pieces of the Chinese e-commerce titan in Hong Kong, taking advantage of regulations that will allow the listing of companies with dual-class shares.

China’s richest man welcomed the relaxation of restrictions, a factor in Alibaba Group Holding Ltd.’s 2014 decision to list in New York in the world’s largest initial public offering — a record that still stands. The online shopping giant has since grown into an internet empire spanning cloud services, music and video streaming with stakes in healthcare, logistics and film.

“We will consider listings in Hong Kong for Alibaba subsidiaries but we have not decided yet which one,” Ma told Bloomberg in an interview after meeting French President Emmanuel Macron, who’s spending time with business leaders in Beijing.

Scoring a listing from one of China’s largest corporations would be a triumph for Hong Kong’s stock exchange, which is eyeing changes to vie for business with its international rivals. HKEX plans to allow companies with dual-class share structures as part of a slew of measures that could see the biggest changes to its listing rules since 1993.

The overhaul is intended to catch a new wave of fast-growing Chinese companies that’re approaching the stage where they might go public, from Ma’s own Ant Financial to smartphone maker Xiaomi Corp. and Tencent Music, an arm of social media leader Tencent Holdings Ltd.

Ma on Tuesday made no mention of Ant — the payments affiliate that sprang from Alibaba’s e-commerce business and that’s said to be eyeing an initial public offering as soon as this year.

Read more: Jack Ma Debt Giant Grinds to Halt as China Curbs Micro-Loans

Ma also stressed Alibaba’s interest in the French market, a source of everything from wine to fresh produce for China’s growing middle classes. Alibaba is considering building a logistics center in the European country to handle shipping, he added.

“We’re expecting more small businesses in France to join us, to reach the market in China,” Ma said. “We’d like to open to French consumers too.”

To contact Bloomberg News staff for this story: Helene Fouquet in Paris at [email protected], Peter Martin in Beijing at [email protected].

To contact the editors responsible for this story: Robert Fenner at [email protected], Edwin Chan, Fion Li

©2018 Bloomberg L.P.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com