After three years, natural rubber prices have dropped below Rs 160 a kg, owing to a slowdown in production in the automobile segment, especially trucks and buses. An increase in natural rubber production in the last three months also led to the fall in prices.

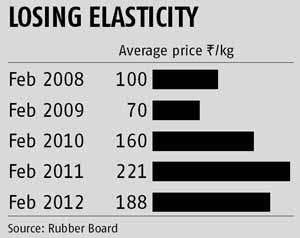

Today, the price of the benchmark RSS-4 grade fell to Rs 157 a kg at the local market. However, international prices were much higher than the Indian counters. In the Bangkok market, the commodity was traded at Rs 178 a kg. A year earlier, RSS-4 was quoted at Rs 188 a kg at the Kottayam market. The average price in February 2011 was Rs 221; in February 2010, it was Rs 160.

According to an International Rubber Study Group (IRSG) report, global production in the April-December period rose 3.2 per cent, while consumption fell 1.1 per cent. Consumption in the US and EU declined considerably, while consumption growth in China was low. IRSG estimates 2012 global production and consumption of natural rubber at 11.41 and 10.95 million tonnes, respectively, with a surplus of 4,60,000 tonnes. In 2013, production and consumption would stand at 11.77 and 11.59 million tonnes, respectively, with a surplus of 1,79,000 tonnes. As the overall trend in the global market is bearish, prices would remain low in the next couple of years, experts say.

Domestic production of natural rubber in April-December is estimated at 6,93,200 tonnes; consumption is estimated at 7,42,330 tonnes, a rise of 3.2 over the corresponding period of the previous year. Consumption in November and December fell four and eight per cent, respectively, said Sheela Thomas, chairman, Rubber Board.

She added apart from demand-supply, prices were also influenced by factors such as weather, currency exchange rates, oil prices, policy changes in major countries and speculative factors.

The volatile futures market is a major concern for stakeholders, especially growers; they see an orchestrated effort to manipulate prices in favour of consumers. Rajiv Budhraja, director general, Automotive Tyre Manufacturers Association told Business Standard volatility in futures trading was a critical factor. “When the price increased heavily, we had pointed to the bad influence of futures trading, nobody cared about that. Now, the new phase is in favour of consuming industries,” he said.

The gap between global prices and Indian ones have widened, as Indian counters are much below the international benchmark. A few weeks earlier, local prices were much higher. The reversal may hit rubber imports, as the price of standard Malaysian rubber (SMR-20) is more than the price of RSS-4 grade in India. In Bangkok, SMR-20 is quoted at Rs 165 a kg. Local importers, including tyre companies, prefer to import the SMR-20 variety; though its quality is similar to that of the benchmark RSS-4 grade, its price is much lower. This is the most important factor behind the sharp rise in imports this financial year.

Till November 2012, international prices were lower than prices in the Kochi and Kottayam markets by Rs 15-18 a kg, owing to which industries chose the duty-free channel for imports. The SMR-20 grade was traded at Rs 150-155 a kg, and this attracted imports to India.

According to N Radhakrishnan, former president, Cochin Rubber Merchants Association, excess supply in the local market is the main reason behind the sharp fall in domestic prices. Local rubber-based industries now have substantial inventory, as they imported huge volumes when they had a price advantage in the international market. Now, local demand is low, and this has hit prices. He added now, production was good, as tapping was underway in plantations in Kerala and Tamil Nadu. As this might continue till the end of this month, RSS-4 prices might drop to below Rs 150 a kg, he said.

Source: business-standard.com