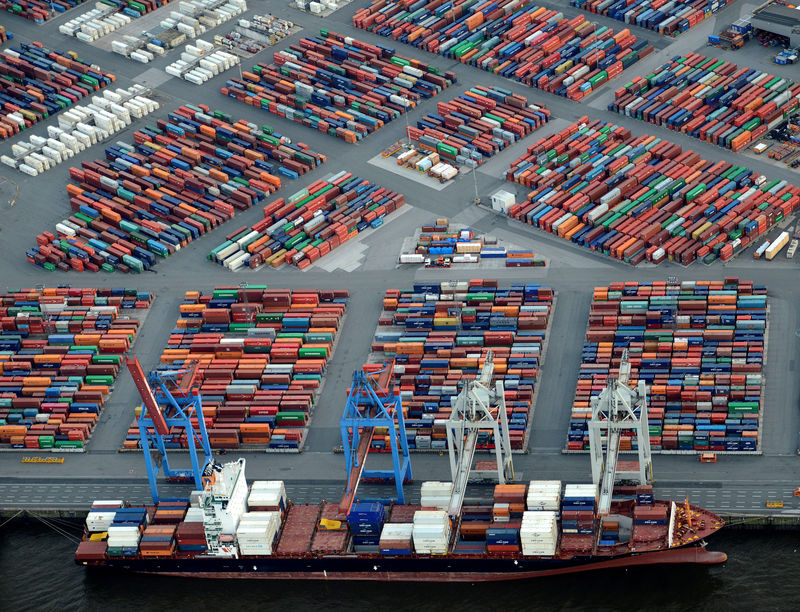

© Reuters. FILE PHOTO: A container ship is loaded at a terminal in the harbour of Hamburg

© Reuters. FILE PHOTO: A container ship is loaded at a terminal in the harbour of HamburgBERLIN (Reuters) – Germany’s current account surplus was the world’s largest in 2017, the Munich-based Ifo economic institute said on Tuesday, unveiling a record high reading likely to renew criticism of the economic and fiscal policies in Europe’s largest economy.

The International Monetary Fund (IMF) and the European Commission have for years urged Germany to lift domestic demand and imports in order to reduce global economic imbalances and fuel global growth, including within the euro zone.

Ifo said the German current account surplus — which measures the flow of goods, services and investments — was the world’s largest for the second year running in 2017 at $287 billion, followed by Japan with $203 billion.

U.S. President Donald Trump has criticized Germany for doing too little to reduce its trade surplus with the United States, accusing Germany of “very bad” trade policies.

Chancellor Angela Merkel has pushed back, pointing to private consumption becoming the main driver of growth.

Merkel also pointed out that the German surplus is mainly a result of the interplay of supply and demand on global markets and that Berlin has only limited influence on other important factors such as the euro exchange rate and energy prices.

China slipped to third place with a surplus of $135 billion, less than half Germany’s.

The German current account surplus fell to 7.8 percent of total output in 2017 from 8.3 percent in the previous year.

“Traded goods are the main reason for the German surplus,” said Ifo economist Christian Grimme. “The main driver was high demand from the European Union and the United States.”

In the first 11 months of last year, Germany’s trade surplus in goods was 249 billion euros ($304.85 billion) as exports continued to outstrip imports.

($1 = 0.8168 euros)

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com