SINGAPORE (ICIS)–Butadiene (BD) buyers in Asia, particularly in the downstream synthetic rubber sector, are resisting sellers’ proposed price hike this week amid limited tank space in the region.

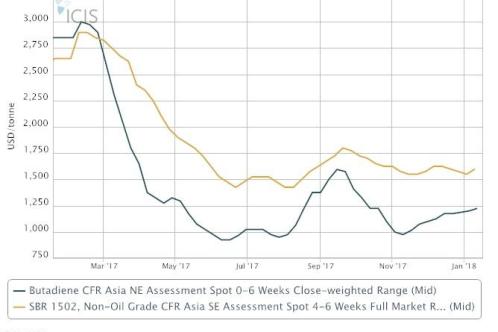

Buying indications for fresh February BD shipments were $100/tonne lower than the spot offers of $1,300-1,350/tonne CFR (cost and freight) northeast (NE) Asia.

“We can buy BD and pay around the low-to-mid $1,200/tonne CFR NE Asia level, if we can find an empty tank,” a downstream SR maker said.

On 12 January, BD spot prices were assessed at $1,200-1,250/tonne CFR NE Asia, ICIS data showed.

Limited tank space has curbed appetite for spot cargoes, market sources said.

“The tanks are filling up fast and it is very difficult to find available storage tanks for late February or early March deliveries, so prices may not go up as much as expected,” a trader said.

Deep-sea cargoes from Europe and the US have arrived in Asia this month, with more supply heading to the region for late-February and early-March delivery.

About 50,000 tonnes of BD from EU, the US, Middle East and Latin America have been procured by Asian buyers, which are restocking ahead of prior to the Lunar New Year holidays in mid-February.

The Lunar New Year, which falls on 16 February, is celebrated in most parts of northeast and southeast Asia, with the key Chinese market on holiday on 15-21 February.

BD sellers were hoping to raise prices above $1,300/tonne on the back of improving downstream synthetic rubber market, which is being bolstered by rising prices of rival product, natural rubber (NR).

Synthetic rubbers, such as styrene butadiene rubber (SBR) and polybutadiene (PBR) prices; and NR are substitute raw materials in the production of tyres for the automotive industry.

Fresh spot offers for February shipments of non-oil grade 1502 SBR and high-cis grade PBR have gone up by $50-100/tonne from the previous month.

Non-oil grade 1502 SBR prices were assessed at $1,550-1,650/tonne CFR southeast (SE) Asia on 10 January, while high-cis grade PBR stood at $1,650-1,750/tonne CFR SE Asia on 11 January, ICIS data showed.

At midday, the SMR20 tyre grade NR price was at $1,541/tonne FOB (free on board) Malaysia, down by an average of $76/tonne from the start of the year.

Focus article by Helen Yan

Picture: A mechanic checking a tyre. Butadiene (BD) is a raw material in the production of synthetic rubbers, which go into tyres for the automotive industry. (Source: WestEnd61/Rex/Shutterstock)

By Helen Yan