Rubber futures declined to the lowest level in more than two weeks as a stronger yen cut the appeal of the contracts denominated in the Japanese currency, and as concerns grew that demand from China may weaken.

The contract for July delivery lost as much as 2.8 percent to 315.2 yen a kilogram ($3,359 a metric ton), the lowest level since Feb. 1, before trading at 319.6 yen on the Tokyo Commodity Exchange at 10:25 a.m. The drop pared this year’s gain for the most-active contract to 5.7 percent.

The yen traded at 93.81 per dollar after touching 94.46 on Feb. 11, the weakest since May 2010. Japan’s Finance Minister Taro Aso said the government isn’t considering changing laws governing the central bank. Retail sales in China gained at the slowest pace since 2009 during last week’s Lunar New Year festival, a Ministry of Commerce statement showed Feb. 15.

“The market was weighed down by concerns about the strength of Chinese demand,” Kazuhiko Saito, an analyst at broker Fujitomi Co. in Tokyo, said today by phone. “Futures in Tokyo also lost support from the currency market.”

Natural-rubber stockpiles monitored by the Shanghai Futures Exchange rose 1,201 tons to 100,015 tons, nearing an almost three-year high reached in January, data from the bourse showed on Feb. 8. The figures will be updated on Feb. 22. The contract for September delivery on the exchange was little changed at 26,225 yuan ($4,201) a ton.

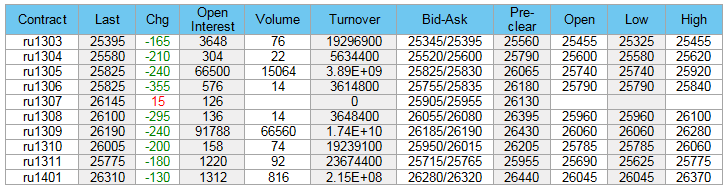

SHFE Rubber Futures Prices on February 19, 2013 (yuan/kg)

Thai rubber free-on-board was unchanged at 97.45 baht ($3.26) a kilogram yesterday, according to the Rubber Research Institute of Thailand. Output in Thailand’s southern provinces, the main production area, is expected to decline in the next few weeks, the institute said on its website.

Source: Bloomberg