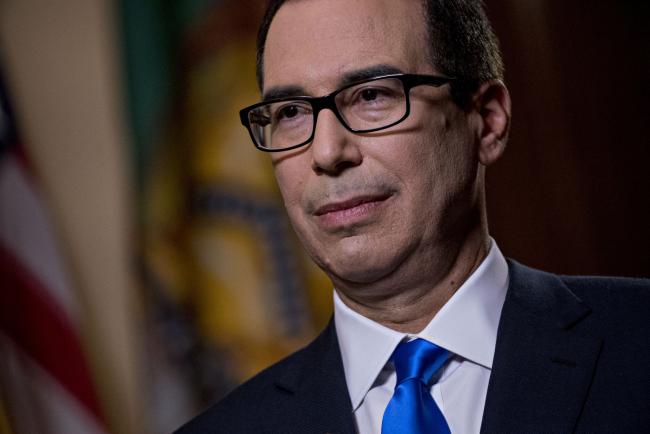

© Bloomberg. Steven Mnuchin

© Bloomberg. Steven Mnuchin(Bloomberg) — Finance ministers from the world’s largest economies struggled to block President Donald Trump’s push to erect trade barriers that many warned threaten to undermine the broadest global expansion since 2010.

Policy makers from the Group of 20 finished talks in Buenos Aires Tuesday with little to show for their efforts to convince U.S. Treasury Secretary Steven Mnuchin to pare back protectionist steps, including new metal tariffs. Rather, the U.S. ended up co-opting allies, many of whom lobbied for exemptions at the gathering.

After two days of talks, the G-20 removed from the final statement language it previously used to fight protectionism and inward-looking policies. And for the first time, the G-20 highlighted the rising risk of cypytocurrencies.

The March 19-20 meeting occurred at a pivotal time for world leaders, as Trump starts to make good on campaign pledges to rebalance global trade in America’s favor. The international response threatens to escalate trade tensions and undermine global economic growth, and is fueling uncertainty in markets that are already on edge as investors brace for higher U.S. interest rates.

‘Trade Wars’

“From all the talks in Buenos Aires, one can draw the conclusion that most people have great concerns if an escalation would occur and trade wars would determine the future,” German Finance Minister Olaf Scholz told reporters on his return home.

The meeting — the first of a series of ministerial-level events that will culminate with a leaders summit in Argentina in November — sought to find common ground on key economic developments and risks. The G-20 statement noted the rise of cryptocurrencies and the need for oversight.

“Crypto-assets lack the key attributes of sovereign currencies,” according to the communique. “At some point they could have financial stability implications.”

But trade took center stage in the Argentine capital, where global finance chiefs were unusually blunt in warning that the Americans are putting at risk the very international trade order that they helped create.

“The common understanding is no one wins in a trade war,” Italy’s Finance Minister Pier Carlo Padoan said in an interview.

Impose Duties

In addition to this week’s steel and aluminum tariffs, Trump is considering plans to impose duties worth as much as $60 billion on Chinese products. The U.S. president has also singled out Germany, Europe’s largest economy, for running up a large trade surplus with his country.

The European Union threatened to retaliate against metal tariffs by raising barriers on iconic American products including motorcycles and bourbon. Bloomberg Economics estimates a full-blown trade war where numerous countries get involved could cost the global economy $470 billion, which is roughly the size of Thailand’s output.

The potential for trade tensions is already impacting some economies. German investor sentiment slumped to its lowest level since September 2016 as concern intensified that the world’s third-largest exporter could be hurt by a trade war and a strengthening euro.

Circumvent Barriers

The tension was evident in the halls of the G-20 meetings in Buenos Aires, as many participants expressed frustration with the U.S. Delegates tried to finalize a communique that would please all nations.

But there are also signs that some countries are trying to circumvent U.S. import barriers by securing sweetheart exemptions from tariffs. While Germany’s Scholz was in close contact with Mnuchin in Buenos Aires, Chancellor Angela Merkel dispatched her economy minister to lobby Commerce Secretary Wilbur Ross in Washington.

The Trump administration is pressing countries to join the U.S. in pushing back against Chinese trade policies in exchange for relief from tariffs, a European official in Brussels said.

According to Bloomberg Intelligence, top U.S. military allies — the EU, South Korea, Japan and Australia — have a good chance of winning exemptions. Countries with troubled security relations with the U.S. such as Turkey, Russia and China are unlikely to ink such a deal.

Source: Investing.com