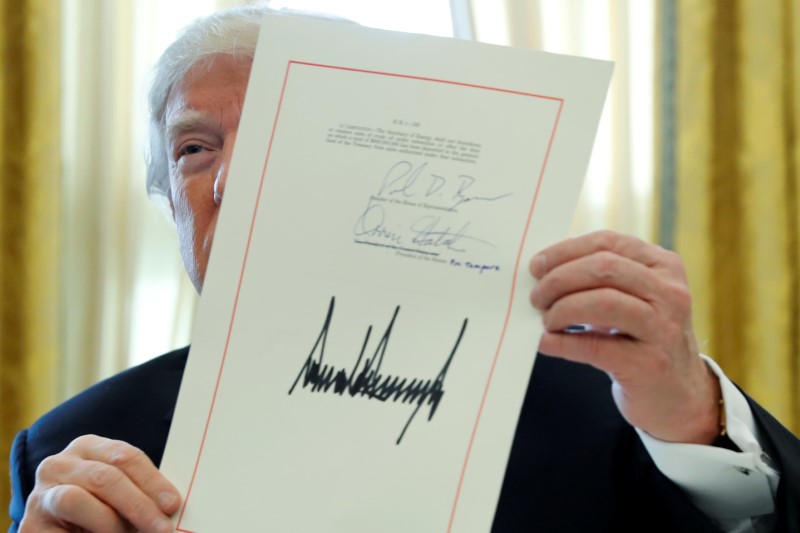

© Reuters. U.S. President Donald Trump signs tax overhaul legislation into law in the Oval Office at the White House in Washington

© Reuters. U.S. President Donald Trump signs tax overhaul legislation into law in the Oval Office at the White House in WashingtonBy Amanda Becker

WASHINGTON (Reuters) – From a “grain glitch” hurting agriculture companies to a write-off for restaurant remodeling, December’s hastily approved U.S. tax overhaul legislation was loaded with mistakes, but hopes of fixing them anytime soon are fading in Congress.

The uphill struggle to pass a “technical corrections” package for the three-months-old tax bill shows how dysfunctional Washington policy-making has gotten, said current and former Capitol Hill aides.

“This is just a small window into how much the process is breaking down,” said Democratic strategist James Manley, who was the spokesman for Harry Reid when he was the Senate majority leader.

Passing technical corrections to major legislation used to be routine. But Republicans blocked corrections to the 2010 Affordable Care Act, former President Barack Obama’s signature healthcare law. Now, Democrats look likely to return the favor.

Three congressional aides said the “grain glitch” correction to the tax bill will not be added to a $1.3 trillion spending bill that Congress has been scrambling to craft ahead of a Friday deadline to avert a federal government shutdown.

Added at the 11th hour to the Republican tax bill, the “grain glitch” gives lucrative tax breaks to grain producers selling to farming cooperatives, and a lesser break for selling to agriculture companies. Its writers admit the wording was a mistake.

The Republican-controlled Congress will need the votes of at least nine Senate Democrats to pass the spending bill. Democrats offered to support a spending bill with the grain fix, so long as a bipartisan measure to expand a low-income housing tax credit was also attached. But House of Representatives Speaker Paul Ryan opposed the plan.

Agriculture companies say they will be hurt without a correction but, without it being attached to a spending bill, there is no clear way forward for tax fixes. Starting on Monday, Congress will be inactive for two weeks until mid-April.

Republican Representative Kevin Brady, chairman of the House tax committee, told reporters on Monday there are “three or four different areas” of tax law needing correction or clarification.

Another problem is that restaurants and retailers say they are prevented from using a new write-off for remodeling expenses. Yet another exempts undefined “corporations” from new rules for deducting carried interest.

Senator Sherrod Brown, a Democratic member of the Finance Committee, said he would only back a “substantive” bill, not cosmetic corrections to the tax law, which Democrats voted against unanimously and criticized as too hastily written.

“They did this with eyes wide open. They knew they’d need dramatic corrections and we’re not just going to lay down for them to rush their breaks for rich people,” Brown said.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com