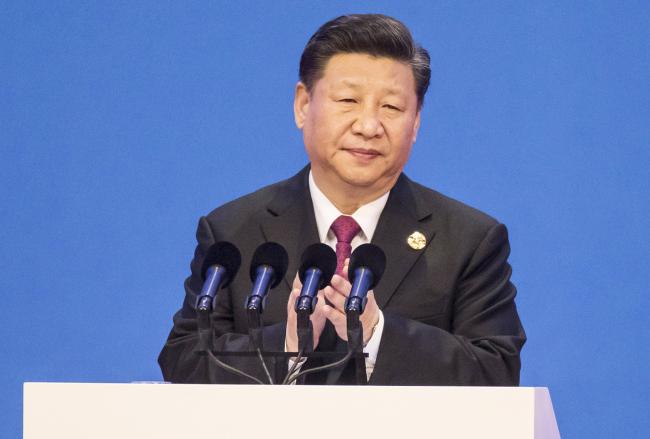

© Bloomberg. Xi Jinping speaks at the Boao Forum for Asia Annual Conference in Boao, China.

© Bloomberg. Xi Jinping speaks at the Boao Forum for Asia Annual Conference in Boao, China.(Bloomberg) — Chinese President Xi Jinping vowed to push ahead with efforts to open the nation’s financial industry this year even as a trade dispute with the U.S. heats up.

China will ensure policies announced last November to remove foreign ownership limits on banks, brokerages and insurers will be implemented in 2018, Xi said at the Boao Forum in Hainan on Tuesday. The nation will accelerate opening of its insurance industry, as well as ease requirements for foreign financial institutions to set up operations and expand their business scope, he added.

Xi gave a deadline for freeing up the nation’s $40 trillion financial sector despite trade tensions stemming from U.S. President Donald Trump’s plans to impose tariffs on Chinese exports. In November, China said it will remove foreign ownership limits on banks and allow overseas firms to take majority stakes in local securities ventures — part of its efforts to “substantially” ease barriers in the industry.

JPMorgan Chase & Co (NYSE:). and UBS Group AG are among global firms that are seeking to increase their stakes in local brokerages as China makes its capital markets more accessible. HSBC Holdings Plc (LON:) has been building its business in the mainland as part of its “pivot to Asia.”

Read more on the hurdles facing global financial firms in China

China has taken other steps to open up its financial industry, including allowing foreign investors greater access to its equities and debt markets through trading links with Hong Kong. Last month, the central bank announced the opening of its $27 trillion payments market, saying foreign companies can start applying for licenses through local units.

Still, foreign ownership of Chinese banks is seen as largely symbolic after global firms including Citigroup Inc (NYSE:). and Goldman Sachs Group Inc (NYSE:). sold stakes in mainland lenders in recent years. HSBC, with a 19 percent stake in Bank of Communications Co., is the only global lender to still have a significant holding.

To contact Bloomberg News staff for this story: Jun Luo in Shanghai at [email protected].

To contact the editors responsible for this story: Marcus Wright at [email protected], Russell Ward

©2018 Bloomberg L.P.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com