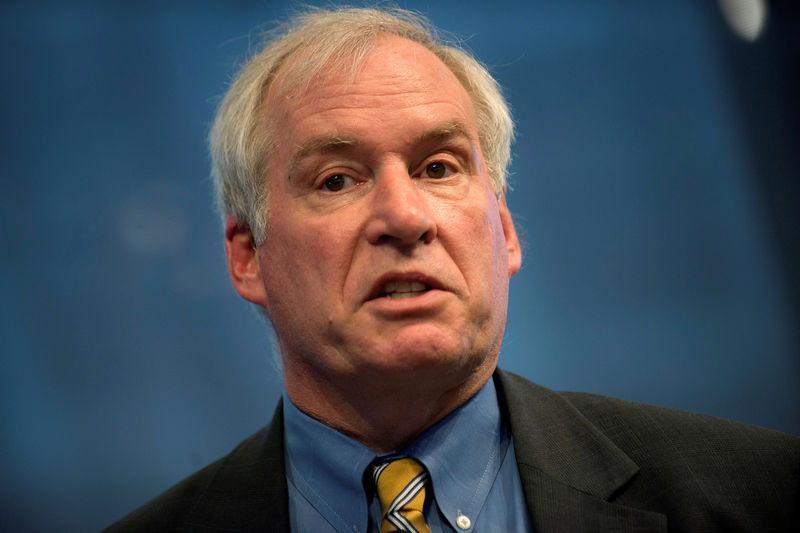

© Reuters. FILE PHOTO: The Federal Reserve Bank of Boston’s President and CEO Eric S. Rosengren speaks in New York

© Reuters. FILE PHOTO: The Federal Reserve Bank of Boston’s President and CEO Eric S. Rosengren speaks in New YorkBy Svea Herbst-Bayliss

BOSTON (Reuters) – The Federal Reserve will probably need to raise interest rates at least three more times this year in the face of a robust U.S. economy, even while possible trade disruptions pose risks, a top Fed policymaker said on Friday.

Boston Fed President Eric Rosengren painted an optimistic picture of strong U.S. job growth, a small rise in inflation, and above-average economic growth. But he also flagged recent trade tariffs and threats of more as a short-term risk, and argued that fiscal stimulus could pose longer-term problems.

“I expect somewhat more tightening may end up being needed” than the median of two more hikes in 2017 forecast by the central bank’s policy-making committee last month, when it delivered the first rate rise of the year, he said.

The Fed is tightening policy gradually after a strong second half to 2017, signs that below-target inflation may be picking up this year, and an unemployment rate that has held for months at a relatively low 4.1 percent.

Rosengren, a veteran policymaker who has shifted to a more hawkish stance in the last two years, said he predicted a “somewhat stronger” economic performance than even the “quite positive” forecasts from the Federal Open Market Committee.

Yet he pointed to the Trump Administration’s metals tariffs and threats of more trade action targeting China as a risk in which “spillover effects are possible (and) difficult to measure,” including a spike in prices.

He also repeated a warning that if unemployment falls too much below what is seen as neutral, the economy risked a “boom-bust” fate. And he noted that recent U.S. tax cuts and government spending “risks not having sufficient fiscal capacity in the future when it might be needed” to head off an economic downturn.

“I am not forecasting significant trade disruptions or substantial boom-bust problems,” Rosengren told the Greater Boston Chamber of Commerce. “But the risk that they could develop means we must be very carefully monitoring.”

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com