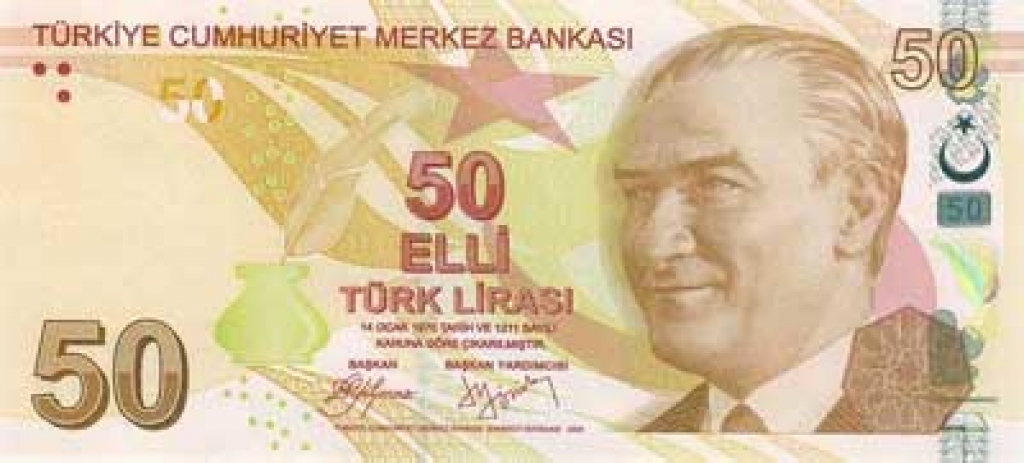

ISTANBUL: Turkey’s lira tumbled 1.5 percent to a record low against the dollar on Friday on nagging worries about the central bank’s ability to rein in double-digit inflation and as the US currency made broad gains.

ISTANBUL: Turkey’s lira tumbled 1.5 percent to a record low against the dollar on Friday on nagging worries about the central bank’s ability to rein in double-digit inflation and as the US currency made broad gains.

Inflation climbed to almost 11 percent in April, data showed on Thursday, stoked by the lira’s fall against the dollar, now more than 11 percent this year.

Standard & Poor’s exacerbated the currency’s losses when it cut Turkey’s sovereign debt rating further into junk territory on Tuesday.

Accelerating prices are Turkey’s most pressing economic problem, and a growing worry for President Tayyip Erdogan and his ruling AK Party as they head into elections on June 24.

Erdogan, a self-described “enemy of interest rates”, has repeatedly called for lower borrowing costs to fuel loan growth and boost the economy. The central bank’s reluctance to tighten has stoked concerns that it is under political pressure.

The lira was at 4.2880 against the dollar by 0955 GMT after hitting 4.2901, its lowest on record. It is one of the worst performing emerging market currencies this year.

Pressure on the lira reflected foreign selling of bonds and bank shares, as well as questions over the timing of the central bank’s steps to tame inflation, BNP Paribas/TEB Investment strategist Isik Okte said.

“I do not think the central bank can wait until its June meeting in terms of a rate hike and simplifying (policy) with funding through a single rate after the much higher than expected core inflation data,” he said.

Last week, the bank raised its top interest rate by a more-than-expected 75 basis points but analysts said it would need to do more to fight inflation and support the currency. Its next policy-setting meeting is on June 7.

The yield on the benchmark 10-year bond rose to 13.70 percent, a rise of 77 basis points in the last two days. The benchmark 2-year bond rose to 15.28 percent from 15.00 percent on Thursday.

The main BIST 100 share index fell 0.9 percent to 101,984.83 points.

Source: Brecorder