MAINBOARD-LISTED rubber supplier Halcyon Agri Corporation has reported a steep plunge in first-quarter earnings. It put the blame on “depressed” global prices and tough market conditions.

Net profit from continuing operations plummeted to US$264,000 for the three months to March 31, according to unaudited results out on Monday – marking a sharp 98.3 per cent fall on the same period the previous year.

The group in fact ran up losses of US$1.56 million – a turnaround from the S$17.52 million in profits the year before – but was kept in the black by contributions from discontinued operations in Thailand, where the Teck Bee Hang processing business is now classified as an asset held for sale.

Meanwhile, Halcyon Agri’s group revenue dropped by 15.6 per cent year-on-year to US$429.9 million, from US$509.2 million previously, as higher sales volume failed to fully offset the impact of lower rubber prices.

First-quarter results included contributions from newly acquired Halcyon Rubber & Plantations assets and a factory in Indonesia.

Global tyre majors, the group’s biggest revenue contributor, saw an operating loss of US$2.66 million – from an operating profit of US$21.6 million previously – as turnover tumbled on lower sales volumes and prices even as a fall in supply put the squeeze on margins.

But Halcyon Agri’s other business segments – Chinese tyre majors, and the global non-tyre and specialty tyre unit – maintained their profitability.

Earnings per share came in at 0.02 US cent, against 0.96 US cent the year before, while net asset value held steady at 51.96 US cents a share, compared with 52.24 US cents as at Dec 31, 2017.

Halcyon Agri’s outlook statement has forecast an improvement in its Indonesia, Malaysia and Thailand factory sales volumes for the rest of 2018, after the expiry of export curbs under the Tripartite Rubber Council’s Agreed Export Tonnage Scheme in the first quarter.

“While we expect that market prices ahead will be anchored by the volatility caused by economic uncertainties as well as speculative activities, Halcyon Agri remains cautiously optimistic that the market price of natural rubber will improve with its growing demand spurred by increased infrastructure spending such as China’s One Belt, One Road initiative and the growth of e-commerce and, hence, last-mile deliveries worldwide,” the company added.

But it warned that raw material supply continues to be a challenge in Indonesia, with lower prices giving smallholder farmers little incentive to boost rubber production.

“This affects the supply, requiring more aggressive pricing of raw material purchased by our local factories, which in turn, affects our margins,” Halcyon Agri said, pointing to its latest results. “While we remain positive that the current situation will improve, we are conscious that the availability of raw material is dependent on factors beyond our control.”

CEO Robert Meyer, who is also the company’s executive director, said in a media statement: “Global natural rubber prices continued to remain depressed in Q1 2018 despite the implementation of market curbs by member countries of the Tripartite Rubber Council.

“The outdated nature of the rubber industry’s price discovery model leads to volatile distortions of price and value, creating the current price situation that does not incentivise farmers to tap trees or invest in new plantings. This is the greatest threat to the long-term sustainability of the rubber industry.”

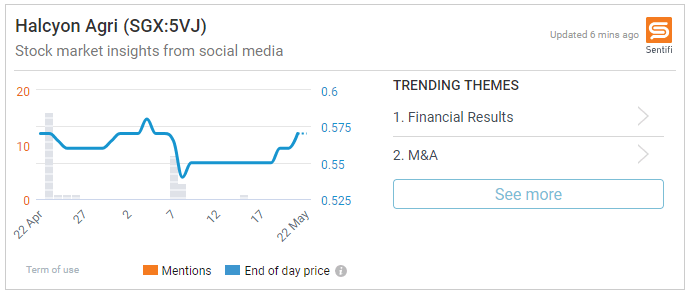

Halcyon Agri closed down by 1.5 Singapore cents, or 2.59 per cent, to S$0.565, before the announcement.