SINGAPORE (ICIS)–Synthetic rubber makers in Asia have started cutting production, with some bringing forward the scheduled turnarounds of their plants, to stem losses arising from surging cost of feedstock butadiene (BD).

Their production margins have been severely eroded by BD’s price spike, which may continue amid tight supply.

“Margins are negative and demand for SBR is weak, we will shut down our SBR plant in July,” a Chinese SBR producer said.

In the key China market, TSRC-UBE (Nantong) Chemical Industrial is bringing forward the maintenance of its 72,000 tonne/year polybutadiene (PBR) plant to June from its original schedule in September.

Chinese producer Shen Hua Chemical has decided to conduct maintenance at its 180,000 tonne/year styrene butadiene rubber (SBR) plant in Nantong in July from the initial schedule of September.

In South Korea, major synthetic rubber producer Kumho Petrochemical Co (KKPC) has reduced the run rates at its SBR units in Ulsan to around 80% and at its PBR units in Yeosu to about 50%, a company source said.

The company can produce 387,000 tonnes/year of SBR and 395,000 tonnes/year of PBR.

SBR and PBR – the main downstream of BD – are raw materials in the production of tyres for the automotive industry.

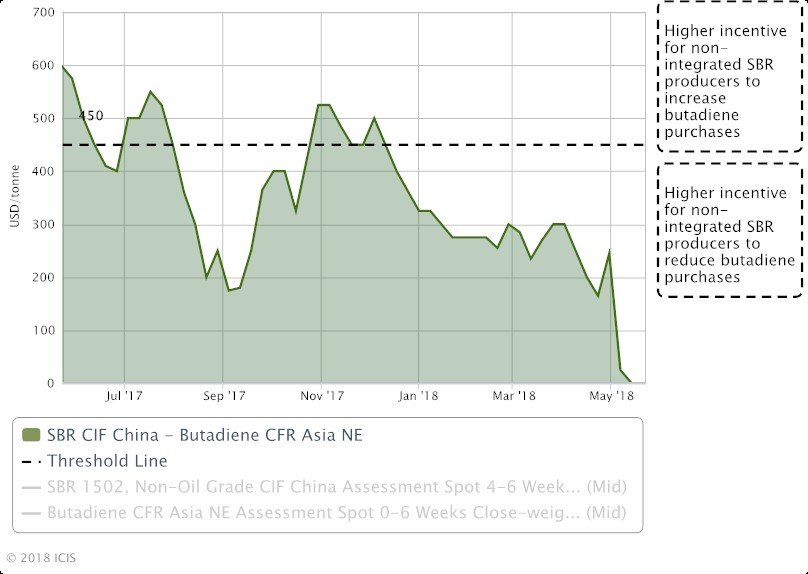

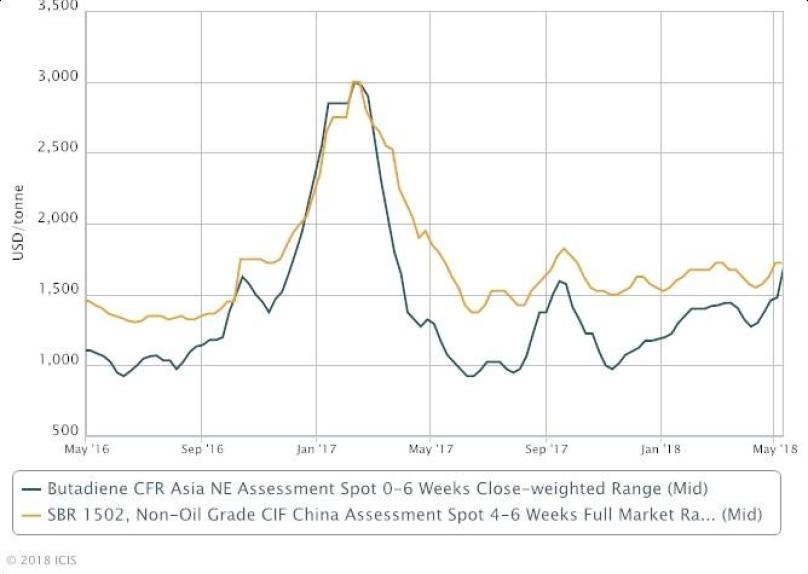

Feedstock BD prices had surged by 37% from early April to $1,750/tonne CFR (cost and freight) northeast (NE) Asia in the week ended 18 May, according to ICIS data.

Spot BD offers are expected to rise further this week amid talk that a spot deal for a 1,000-tonne parcel for late-June loading has been fixed at $1,850/tonne CFR NE Asia this week.

“Supply is really short for June and customers who need to buy June cargoes have to pay a higher price this week,” a trader said.

Further BD gains, however, may be capped as demand will shrink from buyers in the the downstream SBR and PBR sectors.

“The downstream SBR and PBR producers are retreating from the market because their margins have been wiped out by the continuous spike in the BD price,” a trader said.

SBR non-oil grade 1502 prices were assessed at $1,700-1,800/tonne CIF China on 23 May, while high-cis PBR prices stood at $1,900-2,000/tonne CFR NE Asia on 17 May, ICIS data showed.

“The BD price upsurge is not sustainable. It will be more profitable for the downstream SBR and PBR makers to sell BD rather than make SBR or PBR,” another trader said.

Focus article by Helen Yan