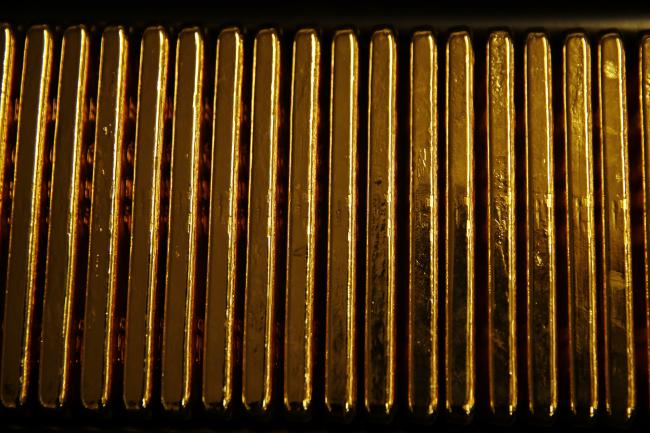

© Bloomberg. One kilogram bars of gold sit stacked in a row at the Valcambi SA precious metal refinery in Balerna, Switzerland, on Tuesday, April 24, 2018. Gold’s haven qualities have come back in focus this year as President Donald Trump’s administration picks a series of trade fights with friends and foes, and investors fret about equity market wobbles that started on Wall Street and echoed around the world. Photographer: Stefan Wermuth/Bloomberg

© Bloomberg. One kilogram bars of gold sit stacked in a row at the Valcambi SA precious metal refinery in Balerna, Switzerland, on Tuesday, April 24, 2018. Gold’s haven qualities have come back in focus this year as President Donald Trump’s administration picks a series of trade fights with friends and foes, and investors fret about equity market wobbles that started on Wall Street and echoed around the world. Photographer: Stefan Wermuth/Bloomberg(Bloomberg) — age-old reputation as a haven is taking a beating.

Although bullion’s had everything going for it this week — from turmoil in Italy and sliding equity markets to a renewal of trade tensions and rethink of the outlook for U.S. rate hikes — prices are still languishing near the lowest this year. Even a warning of peril from investor George Soros didn’t lend a hand.

The yellow metal hasn’t made any headway in 2018, and is poised to close out back-to-back monthly losses in May despite the risk aversion now rippling through markets. The reason lies in the greater appeal of U.S. Treasuries and a rising dollar, according to Stephen Innes, head of trading at Oanda Corp.

“The stronger dollar is the most significant headwind, but with the European fixed-income meltdown in full swing, investors are rushing into the safety of U.S. Treasuries,” Innes said by email. “So this flight to U.S. fixed-income shelters is underpinning the USD, and tarnishing gold’s allure to a degree.”

Spot bullion, which hit a 2018 low of $1,282.18 an ounce last week, was flat near $1,300 on Wednesday while the Bloomberg Dollar Spot Index traded near a November high. On Tuesday, yields on 10-year Treasuries sank 15 basis points, the most since the U.K. voted for Brexit in 2016, but gold was static.

Still, Innes isn’t quitting on bullion just yet. “I’m staying in gold as the downside is limited given the plethora of geo-risks on the table,” he said.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com