SINGAPORE (ICIS)–Asia’s spot butadiene (BD) prices have been falling on weak demand, with the downward pressure likely to persist in the near term as downstream plants cut production amid squeezed margins.

Selling indications were lower this week at around $1,650/tonne CFR (cost and freight) northeast (NE) Asia.

Selling indications were lower this week at around $1,650/tonne CFR (cost and freight) northeast (NE) Asia.

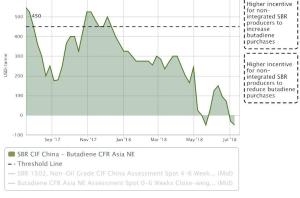

On 13 July, spot prices were assessed at $1,700-1,750/tonne CFR NE Asia, down by $45/tonne week on week after rising 6.1% from 22 June, according to ICIS data.

Traders with stocks-in-hand were prepared to offload cargoes at lower prices this week to entice buyers.

Downstream synthetic rubber (SR) producers, however, have either shut down their plants or are mulling cutting output further.

These include Taiwan’s TSRC, Indonesia’s Gajah Tunggal and South Korea’s Kumho Petrochemical Co (KKPC).

Buying interest for BD from the derivative acrylonitrile butadiene styrene (ABS) makers has also slackened.

“The downstream ABS market is also weakening and buying indications have fallen lower this week,” a trader said.

Several styrene butadiene rubber (SBR) and polybutadiene rubber (PBR) producers, which are the key consumers of BD, are running their plants at reduced capacity due to weak SR market conditions.

SBR and PBR prices have been facing downward pressure as rival product – natural rubber (NR) – is currently available at lower prices.

“NR is about $400-500/tonne cheaper, we have no choice but to cut our operating rates or shut down if the weak market conditions persist,” a downstream SR maker said.

NR is a rival feedstock to SBR or PBR in the production of tyres for the automotive industry and their price movements tend to impact each other.

In China, the SR plants of Yangtze Petrochemical, Shenhua Chemical, TSRC-UBE and Daqing Petrochemical are shut in July and August for maintenance.

Chinese spot appetite for BD imports has largely declined this year, with four new domestic plants with a combined capacity of 400,000 tonnes/year that started up since late-2017 to date.

Spot demand in Asia is mostly driven by buyers in Taiwan and South Korea, which have procuring August and September cargoes.

Buyers expect supply to tighten as regional crackers and BD plants will shut for a turnaround from September.

China has started to export more BD cargoes this year, given its surplus of the material following start-ups of new plants, and amid low domestic prices compared with imports.

Chinese traders and suppliers have exported more than 10,000 tonnes of BD since June, but the arbitrage window has recently closed, market sources said.

“Chinese domestic BD prices have increased and the gap between Chinese local prices and import prices has narrowed,” a Chinese SBR maker said.

“Chinese domestic BD prices are now around Chinese yuan (CNY) 12,500/tonne, which is near $1,600/tonne CFR NE Asia on import parity basis,” he said.

Focus article by Helen Yan

($1 = CNY6.70)

Picture: A labourer at a tyre factory

in Anhui province, China. Butadiene is used as raw material for the production of synthetic rubber, which goes into tyres for the automotive industry. (Source: VIEW CHINA PHOTO/REX/Shutterstock)