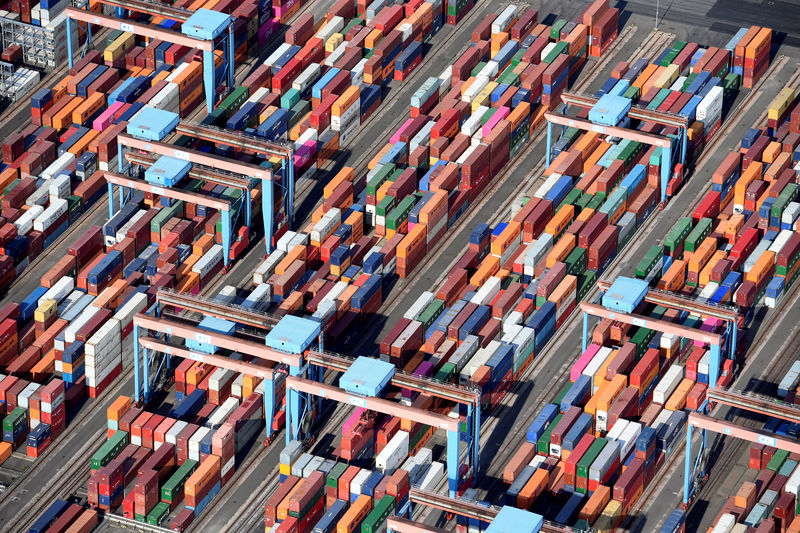

© Reuters. Aerial view of containers at a loading terminal in the port of Hamburg

© Reuters. Aerial view of containers at a loading terminal in the port of HamburgBERLIN (Reuters) – Germany’s hesitancy to reduce its trade surplus is contributing to trade tension and adds to risks that could undermine global financial stability, Maury Obstfeld, chief economist at the International Monetary Fund (IMF), said.

“In (current account) surplus countries such as Germany we see hesitant measures, at best, to counteract the surplus,” Obstfeld wrote in a guest commentary published in German daily Die Welt on Monday.

The IMF and the European Commission have long urged Germany to boost domestic demand by lifting wages and investment to reduce what they call global economic imbalances. Since his election, U.S. President Donald Trump has also repeatedly criticized Germany’s export strength.

Obstfeld said that countries like the United States, in which the external current account balance is too low, should reduce budget deficits, encourage households to save more, and gradually normalize their monetary policy.

Countries in which the balance is too high, like Germany, should increase government spending, for instance by investing in infrastructure or digitalization, so that companies invest more domestically rather than looking abroad.

“The net external positions will diverge more. That increases the risk of disruption by currency or asset price adjustments in indebted countries, to the disadvantage of all,” he said.

“If there is a sudden adjustment, then both the debtor and creditor countries will suffer,” he added.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com