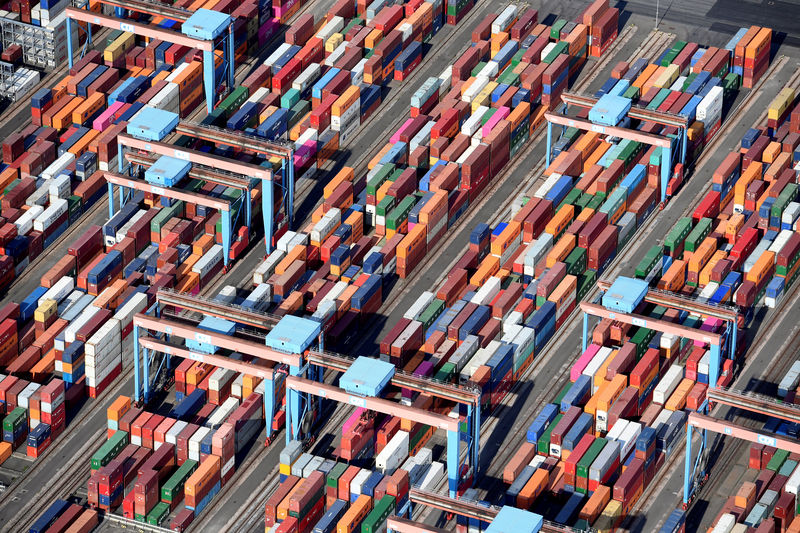

© Reuters. FILE PHOTO: Aerial view of containers at a loading terminal in the port of Hamburg

© Reuters. FILE PHOTO: Aerial view of containers at a loading terminal in the port of HamburgBy Michael Nienaber

BERLIN (Reuters) – U.S. tariffs and sanctions policies are likely to keep investors on their toes in the coming week as European politicians and policymakers continue their summer break, while economic data from Germany and the euro zone will also be in focus.

Washington’s latest sanctions on Russia have battered the rouble, and Turkey’s lira has been hammered by concern that Ankara is sliding into a full-blown economic crisis.

U.S. President Donald Trump’s determination to push ahead with sanctions on Tehran that also target foreign companies doing business with Iran has opened another battle front in addition to a much broader dispute over trade tariffs.

German business associations have warned that companies are increasingly suffering from Trump’s sanctions policies – including those against Iran – as well as the tariffs he is imposing in an escalating tit-for-tat trade conflict with China.

“In terms of geopolitics, the trade war between the U.S. and China could enter center stage again next week,” ING economist Carsten Brzeski said. “Also, keep an eye on Turkey, where some kind of IMF involvement is getting closer.”

Turkey’s lira has plunged to record lows on concerns about President Tayyip Erdogan’s influence on monetary policy and increasingly authoritarian rule, and about a diplomatic rift with Washington over Ankara’s detention of several Americans including an evangelical pastor.

On the data front, Germany on Tuesday will be the last of the large euro zone economies to publish an estimate for gross domestic product (GDP) in the second quarter.

Analysts polled by Reuters expect the quarterly growth rate to pick up to 0.4 percent from 0.3 percent in the first quarter, suggesting that Europe’s largest economy is humming along despite the uncertainty caused by U.S. tariffs and sanctions.

RISING RISKS

Also on Tuesday, the euro zone will report its second estimate for GDP in April-June. Preliminary data last month showed economic growth in the 19 countries sharing the euro slowed to 0.3 percent quarter-on-quarter.

Eurostat’s preliminary figures for euro zone growth have often been revised up in the past, but weaker-than-expected June industrial output data from Germany and Spain have suggested this may not be the case this time.

“An upward revision would change little in economic terms, but could bolster perceptions of stable growth despite rising risks,” Oliver Rakau from Oxford Economics said.

The European Central Bank has said that risks to global growth are growing as the specter of protectionism and the threat of higher U.S. tariffs sap confidence.

Final inflation data for the euro zone due on Friday is likely to confirm that headline consumer price inflation accelerated to 2.1 percent year-on-year in July from 2.0 percent in June, mainly because of a spike in the cost of energy.

The ECB wants to keep headline inflation below but close to 2 percent over the medium term.

“For the ECB all of this means that it can remain on track with its dovish tapering,” ING’s Brzeski said. “The timing of a first rate hike, however, remains extremely uncertain.”

The ECB plans to wrap up its unprecedented 2.6 trillion euro stimulus program known as quantitative easing (QE) by the end of the year and keep interest rates at record lows through the summer of 2019.

Surveys suggest concerns over trade have already begun to dampen investment activity which could translate into meager growth and moderate inflation rates in the second half of the year.

“All of that should not alter the ECB’s QE exit plans, but it will keep all of us busy speculating about the first rate hike,” Rakau from Oxford Economics said.

Source: Investing.com