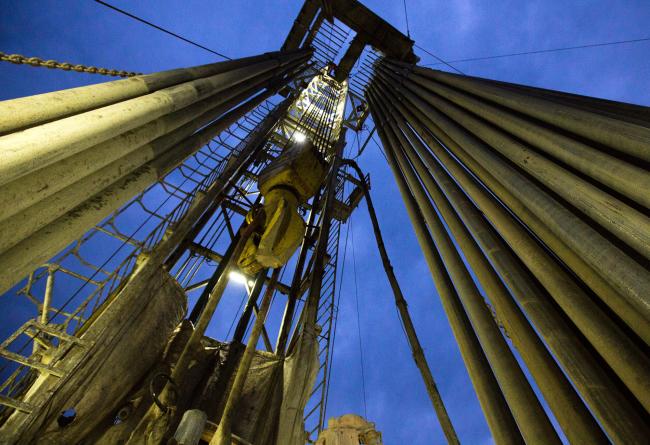

© Bloomberg. The travelling block hangs beside drill pipes on the derrick of a drill rig during oil drilling operations by Targin JSC, a unit of Sistema PJSFC, in an oilfield operated by Bashneft PAO near Ufa, Russia, on Thursday, Sept. 29, 2016. Bashneft distributes petroleum products and petrochemicals around the world and in Russia via filling stations.

© Bloomberg. The travelling block hangs beside drill pipes on the derrick of a drill rig during oil drilling operations by Targin JSC, a unit of Sistema PJSFC, in an oilfield operated by Bashneft PAO near Ufa, Russia, on Thursday, Sept. 29, 2016. Bashneft distributes petroleum products and petrochemicals around the world and in Russia via filling stations. (Bloomberg) — Saudi Arabian Oil Co., the world’s largest crude exporter, said its production last year fell from the annual record it reached in 2016 as it led OPEC and other major producers in curbing output to counter a global oversupply.

The kingdom’s oil production averaged 10.2 million barrels a day in 2017, down from 10.5 million barrels in 2016, Saudi Aramco said in its annual review published Friday. reserves stood at 256.74 billion barrels and condensates were 4.1 billion. production rose to 12.4 billion standard cubic feet a day, up from 12.03 billion standard cubic feet in 2016.

Saudi Arabia led the Organization of Petroleum Exporting Countries’ decision to cut oil production in January 2017 to shrink global inventories and bolster international crude prices. In June, after the market started to re-balance, OPEC and its partners, including Russia, decided to increase production by around 1 million barrels a day to meet consumer demand.

The price for benchmark rose about 41 percent over the past 12 months. Aramco accounts for all of Saudi Arabia’s oil output because a production zone it shares with neighboring Kuwait is closed.

Upstream discoveries last year included two oil fields and one gas deposit, compared with one gas field and two oil deposits in 2016, the company said.

“Saudi Aramco is moving steadily to build a world leading position in the downstream segment of the business,” Chairman Khalid Al-Falih, who is also Saudi Arabia’s energy minister, said in the review.

Saudi Aramco, which plans to sell a stake of around 5 percent in an initial public offering, signaled another potential delay for what could be the world’s largest IPO after it began talks last month to buy a strategic stake in Saudi Basic Industries Corp., known as Sabic, from the country’s sovereign wealth fund.

Amin Nasser, Aramco’s chief executive officer, told Arabiya television in an interview that “a potential Sabic deal would affect the timeframe for Saudi Aramco’s initial public offering.”

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com