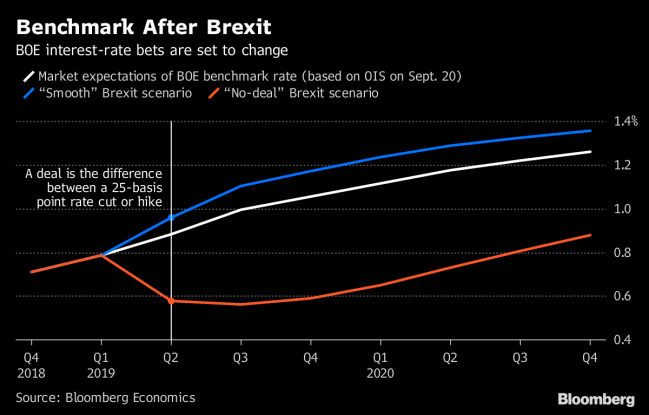

(Bloomberg) — Uncertainty about the terms of Brexit are muddling expectations about the Bank of England’s monetary policy. The yield curve can always be thought of as a weighted average of different outcomes, but at this point, the risks are bigger than usual and more binary than dispersed — there will either be a Brexit deal or there won’t. Bloomberg Economics’ analysis based on the Overnight Index Swap curve suggests that if a deal is the difference between a 25-basis point rate cut or rate hike in May 2019.

To contact the staff on this story: Dan Hanson (Economist) in London at [email protected];Jamie Murray (Economist) in London at [email protected]

To contact the editor responsible for this story: Zoe Schneeweiss at [email protected]

©2018 Bloomberg L.P.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com