SINGAPORE (ICIS)–Asia’s spot butadiene (BD) prices have continued their downtrend this week, opening the arbitrage window to the US market.

Two parcels for late October and early November loading were concluded lower at $1,200/tonne CFR (cost and freight) NE (northeast).

In the week ended 5 October, spot regional prices were assessed at $1,300/tonne CFR NE Asia, representing a 26% plunge from late-August levels, ICIS data showed.

“We are looking at the possibility of exporting 5,000 tonnes of BD to the US in late November or early December,” a South Korean producer said.

At current prices, it is economically feasible for Asian producers to sell to the US taking into account freight cost of $250-300/tonne, market sources said.

“With the BD price in Asia at $1,200/tonne, the Asia-to-US arbitrage window has opened, at least on paper,” a trader said.

Spot BD prices in the US were assessed at 70.50-76.00 cents/lb or $1,550-1,670/tonne CIF (cost, insurance & freight) US Gulf on 5 October, ICIS data showed.

“The margins look workable now with BD in Asia at $1,200/tonne, freight cost at around $300/tonne and BD in the US at around $1,600/tonne,” another trader said.

US buyers, however, may not be keen to procure cargoes as the year is drawing to a close to prevent a build-up in inventory.

“There are concerns over the inventory tax in the US, so likely the Asia-origin cargo is scheduled to arrive in January in the new 2019 fiscal year to avoid the inventory tax,” another trader said.

Shipments from Asia typically take four to six weeks to arrive in the US.

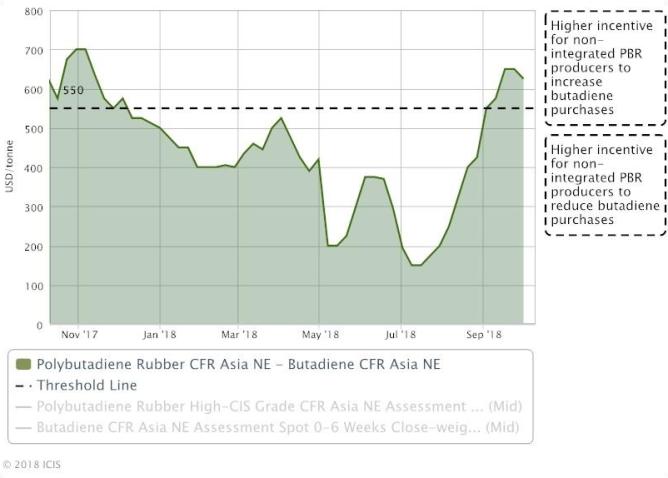

Some market players expect Asia’s BD prices to bottom out soon after falling for six straight weeks since 24 August, which improved the margins of downstream synthetic rubber makers.

In the key China market, spot appetite for BD imports is expected to pick up in anticipation of tightened supplies in the domestic market due to scheduled turnarounds at domestic plants.

Shanghai SECCO’s 90,000 tonne/year BD unit is undergoing a 50- to 60-day turnaround from 8 October, while its other unit with the same capacity was taken off line in September and will restart in November.

Fujian Refining & Petrochemical’s (FREP) 180,000 tonne/year unit is due for a two-month shutdown from the second half of November.

In view of deals done this week, Chinese buyers were hoping to secure cargoes at lower prices of around $1,100/tonne CFR NE Asia.

“There may still be room for BD to fall as … supply exceeds demand in Asia, as there are still several spot cargoes available for November,” a China-based downstream synthetic rubber maker said.

Two sales tenders were issued by Thai producers for November loading this week and are due to close on 11 October.

Bangkok Synthetics (BST) is selling 2,000 tonnes of BD for early November loading, while PTT Global Chemical (PTTGC) is selling a 1,700-tonne parcel for loading in mid-November.

Focus article by Helen Yan