SINGAPORE (ICIS)–Asia’s polybutadiene rubber (PBR) prices may remain under pressure as buyers retreated following heavy losses in feedstock butadiene (BD) market.

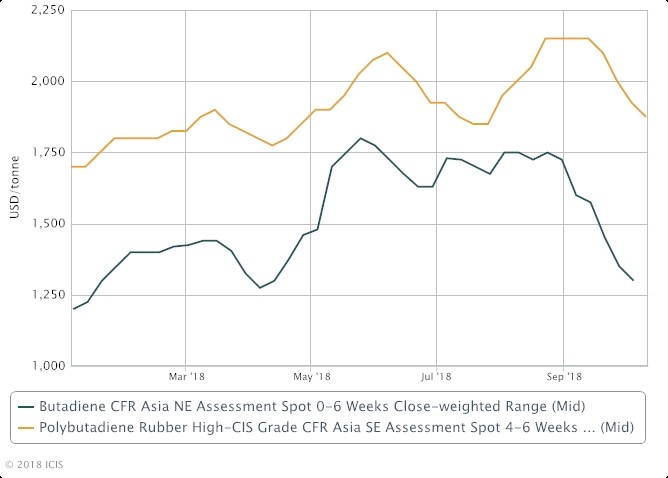

On 11 October, spot prices of high-cis PBR dropped to $1,850-1,900/tonne CFR (cost & freight) southeast (SE) Asia, down by $50/tonne from the previous week, and down by about 13% from late August, ICIS data showed.

Spot activities had almost ground to a halt in Asia this week despite the re-opening of the key Chinese market after a week-long National Day holiday on 1-7 October.

“It is very quiet this week – there are no firm bids as customers are adopting a cautious stance, given that the feedstock BD price had fallen so sharply,” a PBR maker said.

On 5 October, BD prices fell to $1,300/tonne CFR northeast (NE) Asia, down by 26% from 24 August, ICIS data showed.

Buyers have retreated to the sidelines and held back their purchases amid heavy sell-offs in the global equities market and with crude price falling, market sources said.

“I have no enquiries this week at all for synthetic rubber, including PBR. Buyers just wait and watch,” a rubber distributor said.

“Market sentiment is very weak and buyers are staying on the sidelines to wait for a clearer picture,” another rubber distributor said.

Chinese tyre exports to the US have fallen amid the escalating trade war between the world’s two biggest economies.

“Domestic demand for tyres has also slowed in China as the automotive production and sales have fallen,” a Chinese PBR maker said.

In August, China’s vehicles sales fell 3.8% year on year to 2.1m units, according to the China Association of Automobile Manufacturers (CAAM).

PBR is a feedstock in the production of tyres for the automotive industry.

Focus article by Helen Yan