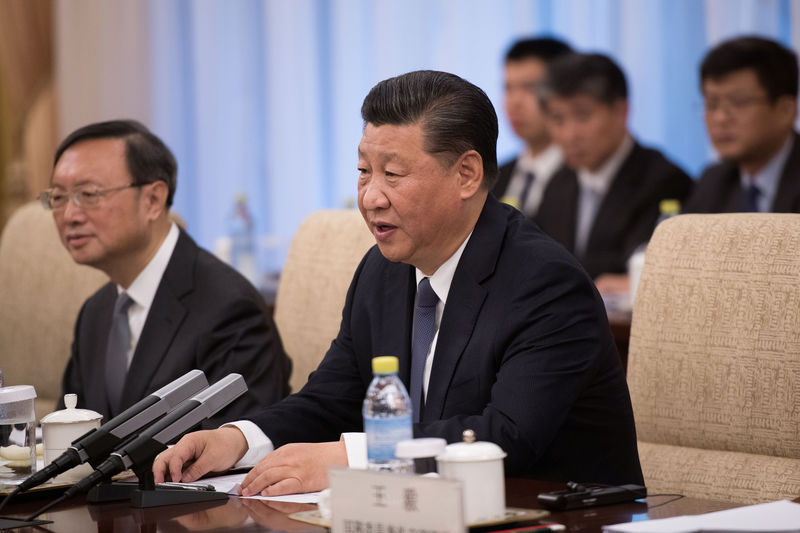

© Reuters. China’s President Xi Jinping speaks with Japan’s Prime Minister Shinzo Abe during a meeting at the Diaoyutai State Guesthouse in Beijing

© Reuters. China’s President Xi Jinping speaks with Japan’s Prime Minister Shinzo Abe during a meeting at the Diaoyutai State Guesthouse in BeijingBEIJING (Reuters) – Chinese President Xi Jinping on Thursday promised support for struggling private firms, pledging more tax cuts and financial aid, underscoring government resolve to support the private sector as growth slows.

Xi said the government would reduce corporate burdens including value-added tax cuts and tax exemptions for small businesses and tech startups, according to the official Xinhua news agency, while promising an equal business environment for all firms.

The country’s private economy could only expand, not be weakened, Xinhua cited Xi as saying.

The remarks come amid a state campaign to shore up confidence in the world’s second-largest economy.

Latest indicators show slowing private consumption and effects of a trade war with the United States are starting to undercut growth, forcing policymakers to respond.

The economy grew by a slower-than-expected 6.5 percent in the third quarter, its weakest since the global financial crisis, and analysts believe business conditions will get worse before they get better.

Authorities have in recent months unveiled a series of fiscal and monetary policy steps including cuts in reserve requirements for lenders, tax cuts and more infrastructure spending in a bid to ward off a sharp slowdown.

The government has recently focused on taking steps to ensure adequate financing for the private sector, particularly smaller firms facing liquidity problems.

China will also seek to expand financing channels for private firms and provide financial aid to firms with healthy prospects, according to Xi.

In a politburo meeting chaired by Xi on Wednesday, the government said it would take more timely steps to support the economy, which faces increasing pressures.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com