TOKYO (Nov 5): Benchmark Tokyo rubber futures fell on Monday, in line with Shanghai contracts, to a near 26-month low as uncertainty around the Sino-US trade war dented appetite for riskier assets.

China will lower import tariffs and continue to broaden market access, President Xi Jinping pledged on Monday, raising his estimate for the country’s imports in the coming years.

Tokyo Commodity Exchange (TOCOM) futures, which set the tone for rubber prices in Southeast Asia, came under pressure after Shanghai futures hit a three-month low.

US stock futures slipped 0.3% after Wall Street closed lower on Friday amid concerns a trade deal between the United States and China may not be struck soon.

“We expect US-China trade tensions to get worse before they get better,” Citi analysts said in a note.

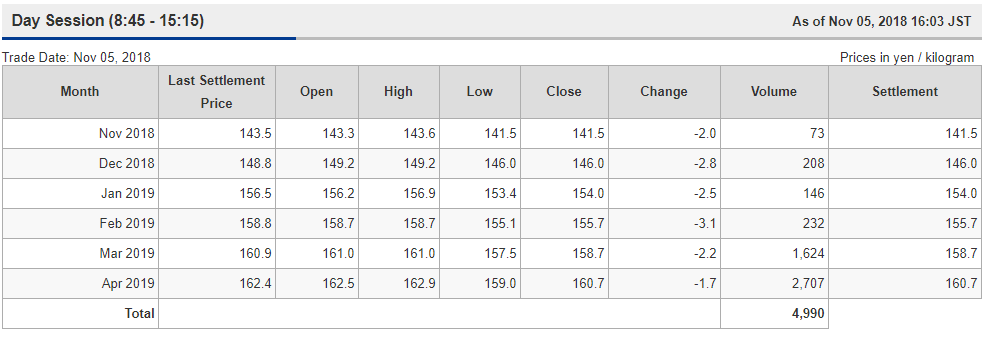

The Tokyo Commodity Exchange rubber contract for April delivery finished 1.7 yen lower at 160.7 yen (US$1.42) per kg after touching 159 yen earlier, the lowest since Sept 16, 2016.

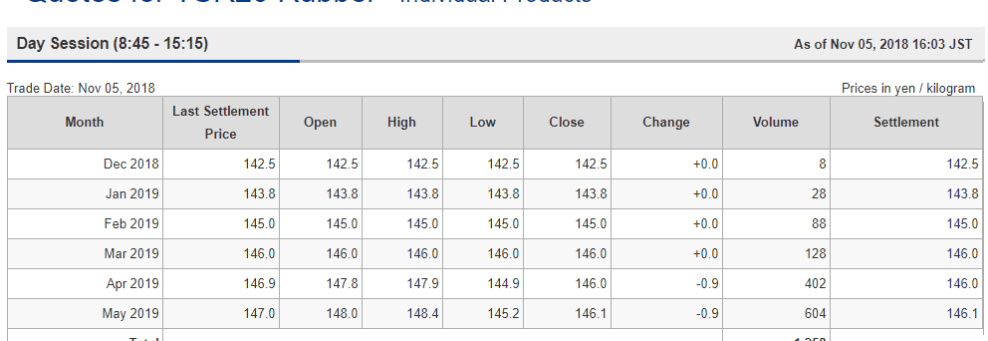

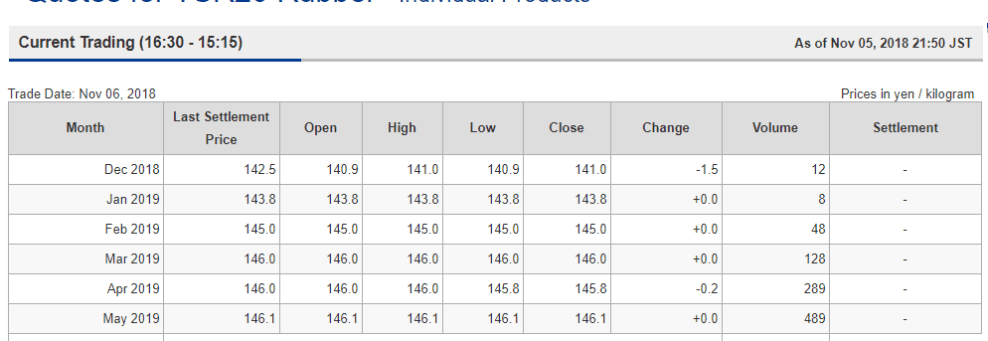

TOCOM’s technically specified rubber (TSR) 20 futures contract for May delivery fell 0.6% to close at 146.1 yen per kg after touching a near one-week low.

The most-active rubber contract on the Shanghai futures exchange for January delivery fell 200 yuan, or 1.8% , to finish at 11,125 yuan (US$1,608) per tonne.

The front-month rubber contract on Singapore’s SICOM exchange for December delivery was last traded at 124 US cents per kg, down 2.2 cents.

(US$1 = 113.2900 yen)

(US$1 = 6.9199 Chinese yuan renminbi)