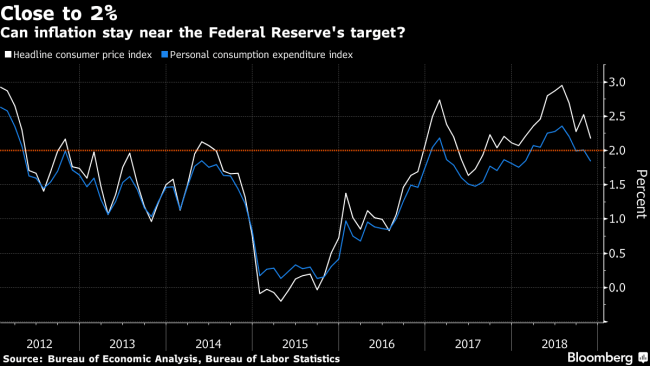

(Bloomberg) — The Federal Reserve is confident that U.S. inflation will come in around its target next year. Heading into 2019 though, bond traders are unconvinced.

“The market is growing increasingly skeptical that we are going to see a roar back in inflation,” said Ben Jeffery, an analyst at Bank of Montreal.

Ructions in stocks and bonds this month, along with concern about economic headwinds, have spurred a decline in how much inflation is priced in for the next few years by fixed-income markets. While economists also have a somewhat less robust growth outlook for 2019 compared with this year, surveys shows they remain optimistic that the pace of inflation will hold firm around the Fed’s 2 percent goal.

The Fed opted to raise rates last week and, stressing that inflation is “just a touch below” where it was expected to be, Chairman Jerome Powell made clear that tightening would persist if the economic outlook remains healthy. That was even as officials trimmed slightly their own forecasts for 2019 price gains and interest-rate increases.

“We’re forecasting that growth will be strong enough that unemployment will drop still further, and inflation will remain right near our target,” Powell said. “That’s a reasonably positive forecast.”

The U.S. president, for one, doesn’t seem persuaded that high inflation is a risk. On Dec. 17, ahead of the latest Fed meeting, Donald Trump tweeted that it was “incredible” that the Fed was considering interest-rate hikes in an environment of “virtually no inflation.” Since then, the president has, according to a report from Bloomberg News that cites people familiar with the matter, discussed the idea of firing the central bank chief, although on Tuesday he expressed confidence in the Treasury secretary, the Fed and the economy.

Policy Mistake?

Some market observers have raised concerns about the possibility of a policy mistake by the central bank, and last week’s Fed views have acted as a further drag on breakeven rates — the pace of future price gains implied by Treasury Inflation Protected Securities and the consumer price index. Sliding energy prices are also undermining inflation expectations, especially in the nearer term.

“We’ve come along in this economic expansion and failed to see the textbook late-cycle inflation pickup,” said Bank of Montreal’s Jeffery. “The Fed is also showing no signs of blinking yet, which naturally will serve to keep a lid on inflation. That’s why breakevens are falling off a cliff.”

The most recent figures on the Fed’s preferred price gauge — tied to personal consumption expenditures — and the so-called core PCE, which excludes food and energy, showed the annual gain remained a little under the central bank’s 2 percent target.

All that sets up a possible reckoning between inflation bulls and bears. Those economists making the bullish case point to steady U.S. growth that may allow companies to regain some pricing power and a tight job market that puts upward pressure on wages. Average hourly earnings have climbed at a 3.1 percent year-on-year pace for two straight months, the best showing since 2009, and the unemployment rate is the lowest in almost half a century. There’s also a risk that the trade war between the U.S. and China will spark higher prices globally.

“Core inflation is going to continue to pick up, as it has this year,” said Stephen Stanley, chief economist at Amherst Pierpont Securities, who sees core PCE moving back above 2 percent. “After a soft patch, we’re getting back to the trend that’s been in place.”

Others point to factors that could cap inflation, such as the waning of fiscal stimulus effects, ongoing U.S. dollar strength and a weakening housing sector, which may help keep shelter costs in check. A slowdown in global growth could also ease import-price pressures.

“We’ve seen some upward movement, but we’re not seeing any indication of a major breakout on inflation,” said Gregory Daco, chief U.S. economist at Oxford Economics, who expects price gains will hover around 2 percent rather than over-shooting or under-shooting that level. “The inflation outlook will remain fairly modest.”

The rate of inflation priced in over a five-year horizon briefly is down around 1.5 percent, while the 30-year breakeven rate on Wednesday touched below 1.85 percent, the least since August 2017. Those figures are linked to expectations for CPI — which has historically been about 40 basis points on average above the deflator for personal consumption expenditures — indicating that traders are positioned for the central bank to miss its target by some margin.

Morgan Stanley (NYSE:) Investment Management, which oversees $471 billion in assets, says inflation-debt traders are beginning to push things a bit too far. Jim Caron, a fixed-income portfolio manager at MSIM, said he was looking at the possibility of buying TIPS and that he expected the disinflationary impact of falling energy prices to dissipate in the second half of 2019.

“We are in the process of an overshoot in breakeven rates that is getting near the bottom,” he said. “Inflation will start to percolate back up next year. It’s becoming worth the risk of owning these securities.”

Source: Investing.com