(Bloomberg) — If you lost money on emerging Asian bonds and currencies this year, be warned: the first half 2019 may see more of the same.

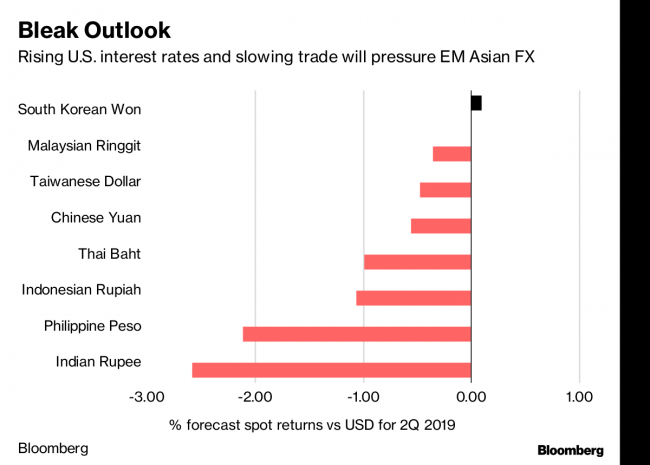

In what could be an unwelcome replay, risk assets are likely to remain at the mercy of the U.S.-China trade war, a messy Brexit and rising U.S. interest rates. Almost all emerging Asian currencies are expected to weaken by the end of June, while bond yields are forecast to rise for countries including Indonesia, India and Thailand, according to estimates compiled by Bloomberg.

“EM Asia is one in which we believe there is still pressure for yields to move higher and curves to steepen, based on our view of the U.S. Treasury curve,” said Roland Mieth, emerging-markets portfolio manager at Pacific Investment Management Co. in Singapore. “The overall outlook for EM Asia government bonds remains cautious.”

Reports due this week on Chinese manufacturing PMI, South Korean exports and Singapore gross domestic product may provide further evidence the region’s economy is losing momentum.

The Bloomberg JPMorgan (NYSE:) Asia Dollar Index has fallen almost 5 percent this year, set for the biggest annual decline since 2015. A Bloomberg Barclays (LON:) index of emerging Asian government debt is heading for its first annual loss in three years.

While the U.S. and China are scheduled to meet in the second week of January for trade talks, Citigroup Inc (NYSE:). says even if the dispute is resolved, the damage can’t be immediately reversed. Asia’s biggest economy is already feeling the chill: retail sales are cooling and industrial profits are down, prompting policy makers to pledge more stimulus.

Positive Signs

There are at least some reasons to be hopeful for emerging Asian assets: oil prices have dropped about 40 percent from their October peak, which is a boon for countries that import the commodity. Central banks remain vigilant, while a growing number of analysts, including those at Goldman Sachs Group Inc (NYSE:). and UBS Group AG, say the dollar is close to its peak.

Meanwhile, positions betting the dollar will strengthen are near the highest in almost two years, which to some traders suggests the currency is set to decline.

“We see less headwinds for Asian local markets from the U.S. dollar as we transition into the new year, but slowing global growth and continued trade frictions will contribute to a challenging macro backdrop,” said Stuart Ritson, portfolio manager for emerging market debt at Aviva (LON:) Investors in Singapore.

“The key factors that will be important in 2019 are the extent of the slowdown in China and the ability of the authorities to keep the CNY stable as well as the ongoing trade frictions with the U.S,” he said.

Emerging markets as a whole may also be due a breather in 2019, according to a Bloomberg survey of 30 investors, traders and strategists. Stocks, currencies and bonds of developing economies have found a floor and will probably outperform their developed-nation counterparts next year, the survey found.

Below are key Asian economic data due this week:

- Monday, Dec. 31: South Korea CPI, China manufacturing and non-manufacturing PMI, India fiscal deficit

- Tuesday, Jan. 1: South Korea exports

- Wednesday, Jan. 2: Singapore GDP, China Caixin manufacturing PMI, Thailand and Indonesia CPI

- Friday, Jan. 4: China Caixin PMI, Malaysia trade balance and India Services PMI

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com