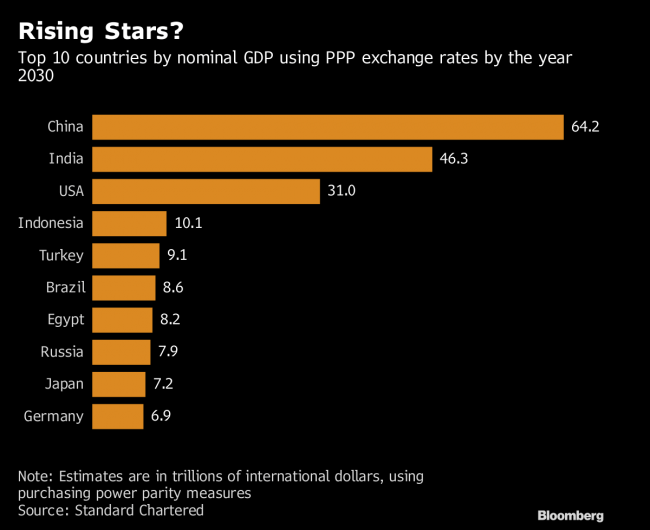

(Bloomberg) — Seven of the world’s top 10 economies by 2030 will likely be current emerging markets.

The prediction for a shake-up of the world’s gross domestic product rankings comes in new long-term forecasts by Standard Chartered (LON:) Plc, which includes a projection for China to become the largest economy by 2020, using purchasing power parity exchange rates and nominal GDP.

India will likely be larger than the U.S. in the same time period while Indonesia will break into the top 5 economies.

“Our long-term growth forecasts are underpinned by one key principle: countries’ share of world GDP should eventually converge with their share of the world’s population, driven by the convergence of per-capita GDP between advanced and emerging economies,” Standard Chartered economists led by David Mann wrote in a note.

They project trend growth for India to accelerate to 7.8 percent by the 2020s while China’s will moderate to 5 percent by 2030 reflecting a natural slowdown given the economy’s size.

Asia’s share of global GDP, which rose to 28 percent last year from 20 percent in 2010, will likely reach 35 percent by 2030 — matching that of the euro area and U.S. combined.

Here are some other findings from Standard Chartered’s economists:

- Waning reform momentum in emerging markets weighs on productivity growth

- The end of the quantitative easing era may mean more pressure on economies to reform and revive productivity trends

- The middle-class is at a tipping point, with a majority of the world’s population entering that income group by 2020

- Middle-class growth driven by urbanization and education should help counter the effects of the rapid population aging trend in many economies, including China

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com